A firm or agency checks the identification of its clients using the Know Your Customer (KYC), or Know Your Client, procedure. Banks, lenders, insurance firms, and other financial and monetary businesses of all sizes are required to go through the procedure.

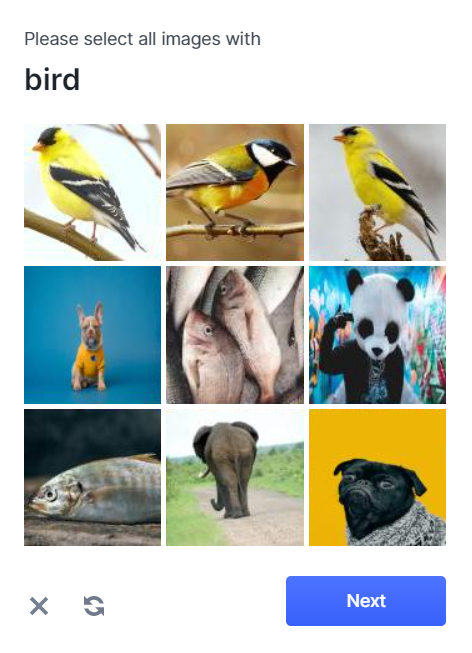

KYC is a data-driven procedure that enables businesses to verify that their clients are who they say they are, to determine if a client is qualified to use their services, and to prevent any harmful or illegal behavior related to utilizing those services.

What is KYC for cryptocurrency? It enables cryptocurrency exchanges and other crypto businesses to confirm the legitimacy of their consumers. Similar to banks.

Why Is KYC Required for Crypto?

Government-regulated institutions must create their own KYC program and internal policies in the present compliance environment based on their own interpretation of the relevant laws and knowledge of the risks they may encounter. Due to this, there are many various KYC criteria, as well as variances in the documentation needed for verification, including passports, utility bills, driver’s licenses, and bank statements, among other things.

To be widely adopted, cryptocurrency must adhere to KYC procedures as a new financial exchange medium. Therefore, it is crucial to talk about KYC’s significance, implementation, benefits, legal context, and future.

The importance of KYC

KYC is crucial for adhering to anti-money laundering (AML) and anti-bribery regulations, as outlined by international and national legislative frameworks. Since 1989, numerous nations have pledged to abide by the Financial Action Task Force’s recommendations; nonetheless, there is no single, universal definition of KYC, and many geographical areas throughout the world have distinct AML or KYC laws.

Overall, KYC’s goal is to stop criminal groups from using financial and non-financial businesses—either purposefully or unintentionally—for money laundering, terrorist funding, and other unlawful activities. Businesses that use KYC procedures can better understand their clients’ financial transactions and can weed out candidates with dubious or dangerous histories. Businesses may therefore simply keep an eye on customer activity and minimize risk.

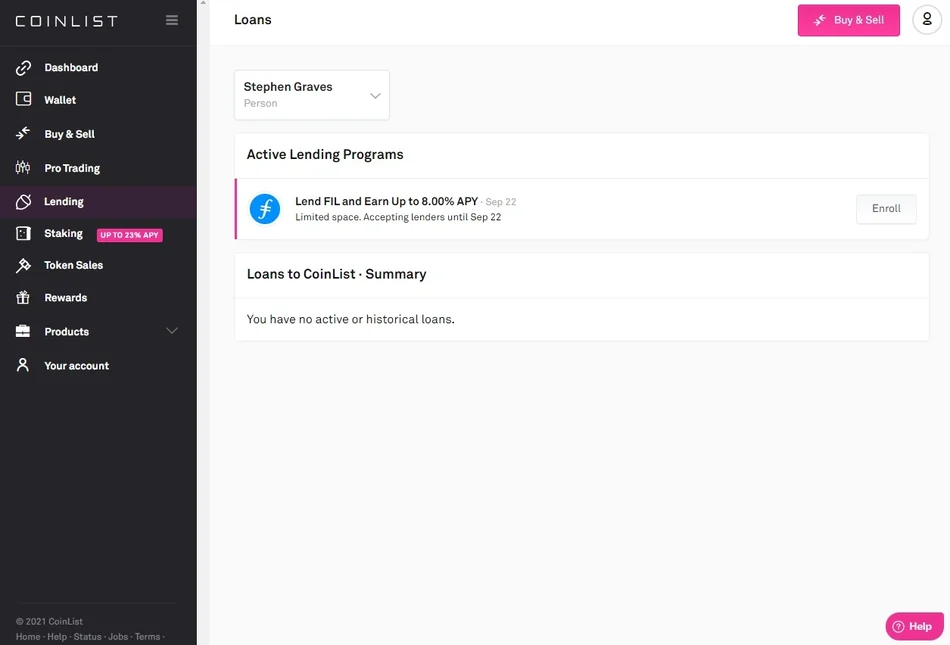

Requirements for KYC in Crypto

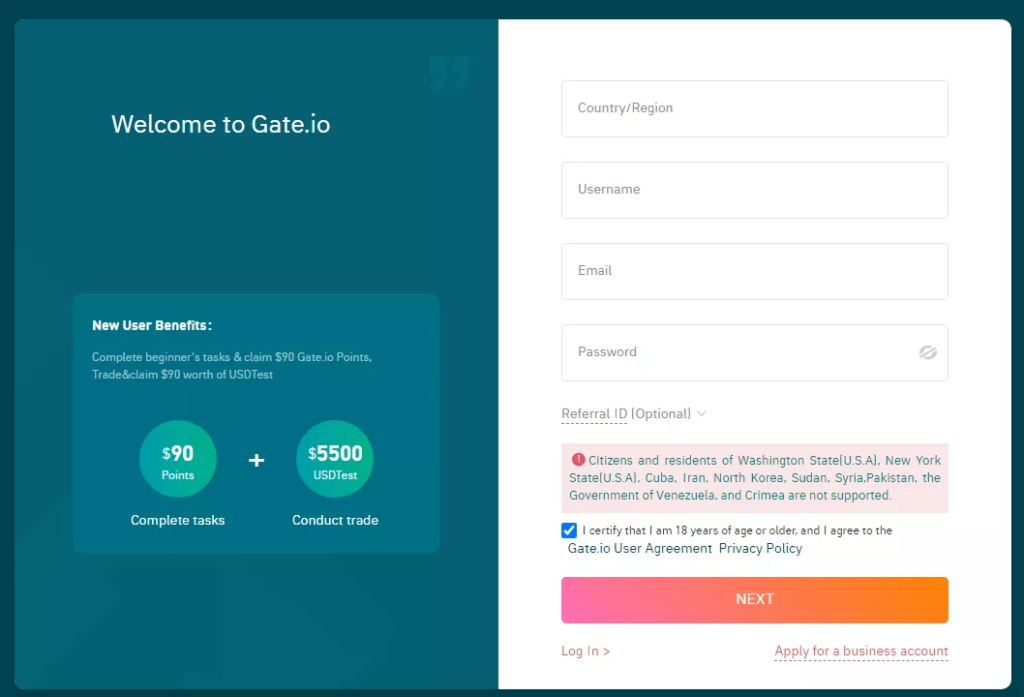

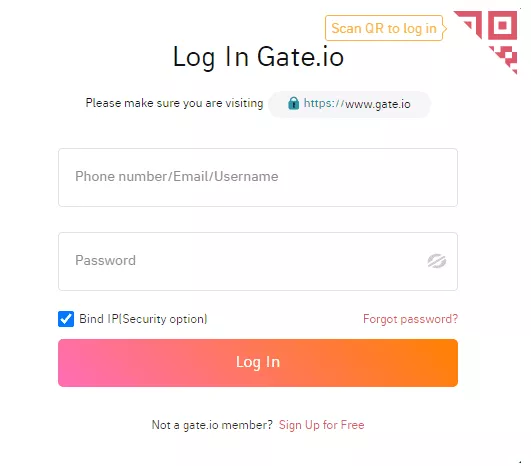

You’ll discover that the KYC requirements for various exchanges vary greatly. Others want government-issued identification and may take several days to validate your account, while some require almost nothing.

The cryptocurrency sector is global, and several nations have quite diverse rules and regulations. Exchanges within the same nation may have various KYC requirements depending on how they interpret the legislation.

Having stated that, the following are some typical criteria you could encounter on various exchanges:

- Full name

- Date of birth

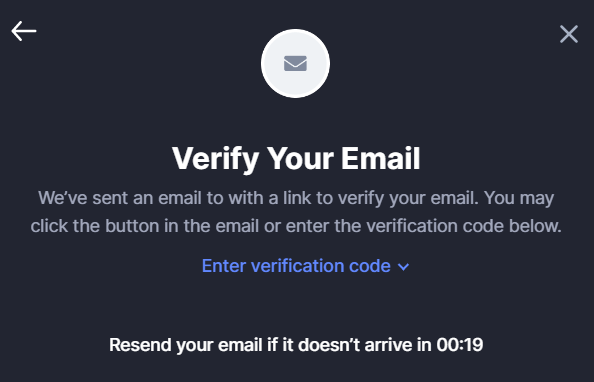

- Phone number and/or email address

- Physical address and/or country of residence

- Photo/scan of government-issued ID such as a driver’s license or passport

- Copy of utility bill

- Photo of yourself with your ID

Is KYC a legal requirement?

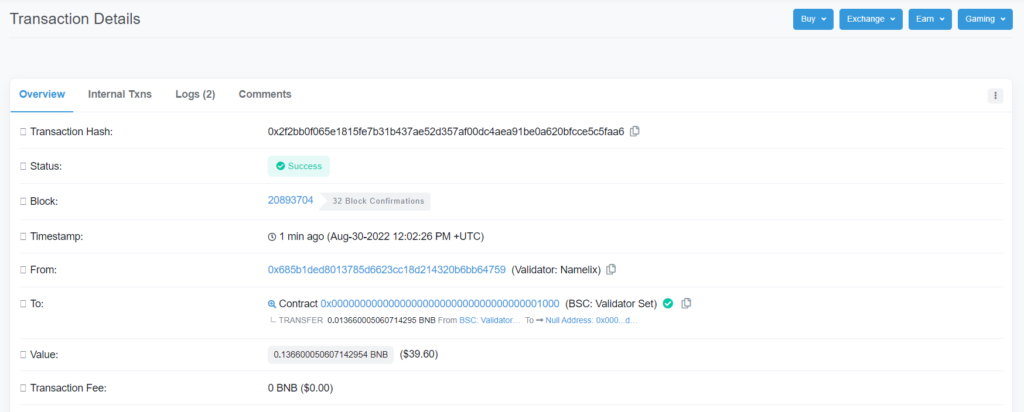

All banks, lenders, insurance companies, and other financial and monetary organizations must comply with the Know Your Customer regulations. When it comes to KYC compliance, cryptocurrency exchanges now operate in a bit of a murky area. With the exception of fiat-to-crypto exchanges, which always want users to go through the KYC procedure as soon as they wish to purchase or sell rather than trade, the majority of crypto-to-crypto exchanges do not require any KYC, as can be seen in the preceding section.

In essence, at this point, the only cryptocurrency exchanges mandated by law to conduct KYC are those that deal with legal cash, whether through exchanges or another method. This is due to the fact that institutions that do KYC verification on the cryptocurrency exchange’s platform must be dealt with by the exchanges.

Is KYC secure for clients?

As long as the business you are dealing with has privacy and security measures in place to secure your information, the Know Your Customer procedure is safe.

As a result, always make sure that you only give information to the firm you are attempting to become verified with. Scammers may try to exploit KYC verification as a ruse to steal your information. It’s crucial to keep in mind that KYC cannot be conducted over the phone since it requires visual paperwork; any phone contact requesting for personal information connected to KYC is a fraud.

Can I buy cryptocurrency without a KYC?

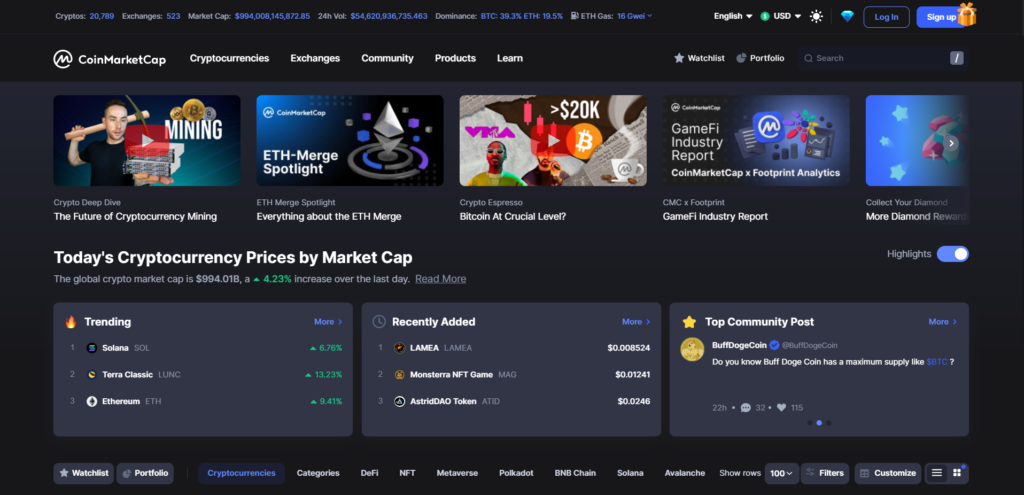

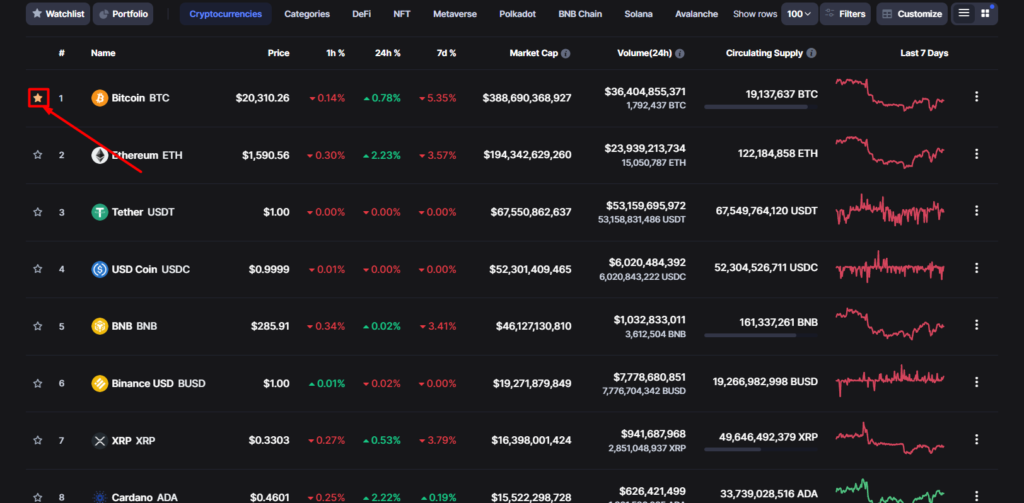

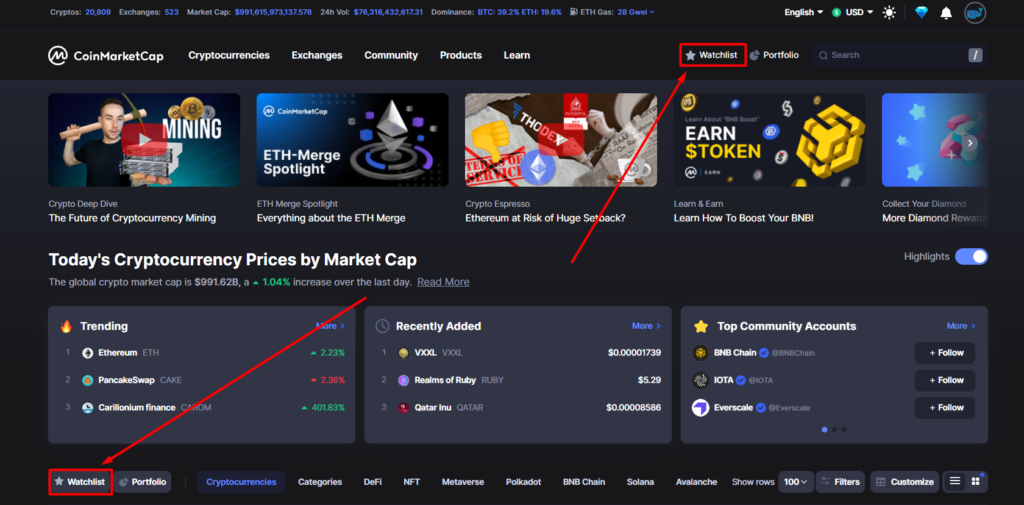

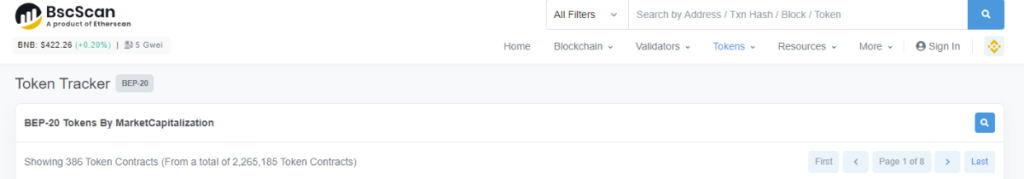

Yes, a lot of bitcoin exchanges, Binance being the most prominent example, do not demand KYC. Kraken, Shapeshift, and Changelly are a few further examples, although they’re not the only ones. A third of cryptocurrency exchanges are said to have little to no KYC.

Peer-to-peer exchanges that let you buy cryptocurrency straight from another user exist, but they come with a high level of risk.

It’s crucial to bear in mind that, despite the fact that joining up without utilizing KYC is simpler and keeps your information private, you run the risk of dealing with criminal activity on the platform and increased attack threats.

Despite being cumbersome, KYC aids in the fight against crime, including underage cryptocurrency trading and money laundering.

Of course, you might equally contend that requiring KYC compromises customer privacy. The majority of significant crypto exchanges continue to demand identification verification in some way.

Is KYC Only applicable to cryptocurrencies?

No, KYC is not just relevant to cryptocurrencies. The KYC initiative was started in 1989 as a means of preventing fraud, tax evasion, funding of terrorism, money laundering, and other financial crimes in conventional financial and non-financial infrastructures. However, it has since been applied to several cryptocurrency exchanges. Even now, those infrastructures demand KYC.

It is doubtful that KYC requirements would alter in the conventional financial and non-financial industries. But there is a lot of disagreement on what should or could happen in the world of cryptocurrencies. In June 2019, the Financial Action Task Force amended its recommendations, requiring that nations make sure that crypto-asset service providers are subject to proper regulation, supervision, or monitoring for AML and countering the funding of terrorism.

Many contend that creating all of the many domestic regulatory agencies will be challenging and that reporting may become onerous. Furthermore, in situations when harmful activity involving the use of cryptocurrencies has taken place, it is not always feasible to accurately determine the identity of a recipient.

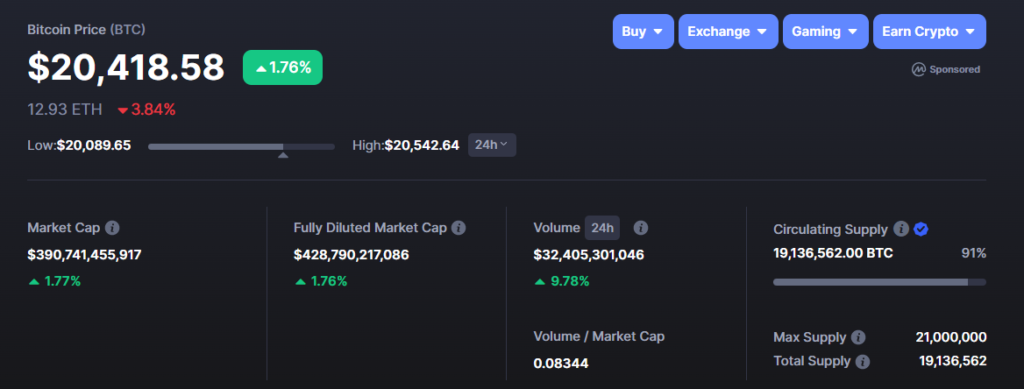

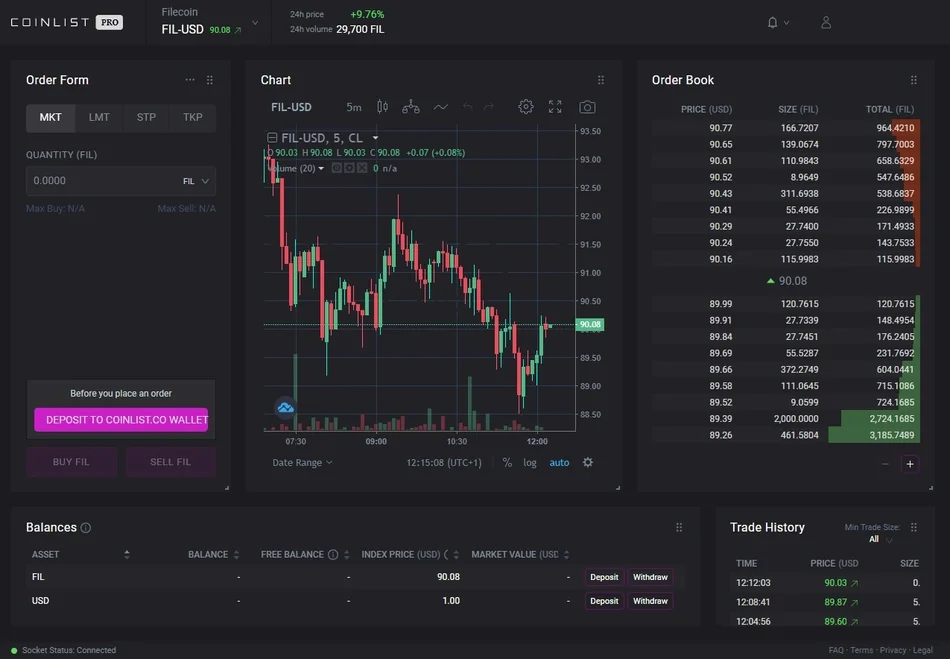

KYC and Crypto-to-Crypto Exchanges

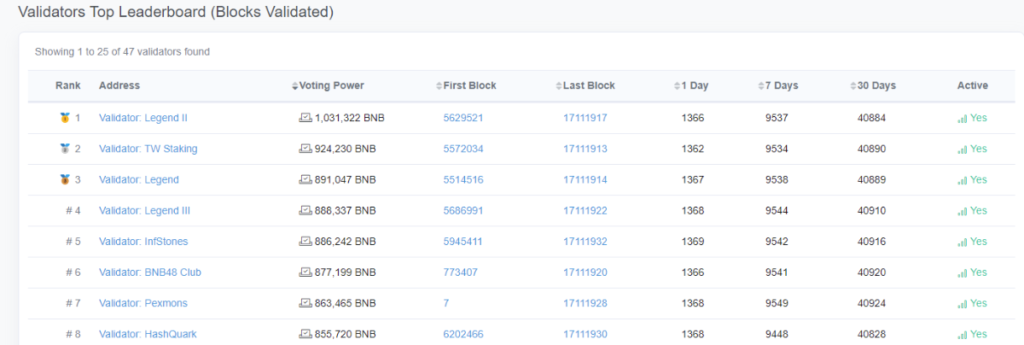

With roughly 30% of them needing no KYC paperwork as of 2019, crypto-to-crypto exchanges usually operate in a tiered fashion and frequently have more liberal KYC standards. One of the major cryptocurrency exchanges in the world, Binance, for instance, does not demand KYC for a basic account. With this account, there are no verification requirements for cryptocurrency deposits or trading; but, if you want to withdraw more than 2 Bitcoin worth of cryptocurrency in a single day, you will need to show proof of your identity in the form of a picture ID.

Similar to Huobi, which has different withdrawal limitations for confirmed and unverified users, KYC is enforced when users exceed a particular account use threshold but does not require any KYC papers to trade.

The majority of crypto-to-crypto exchanges have come under fire for not being proactive enough with KYC. With the exception of Binance, these exchanges have not reportedly been actively tracking or monitoring transactions to look for signs of market manipulation or fraudulent activity.

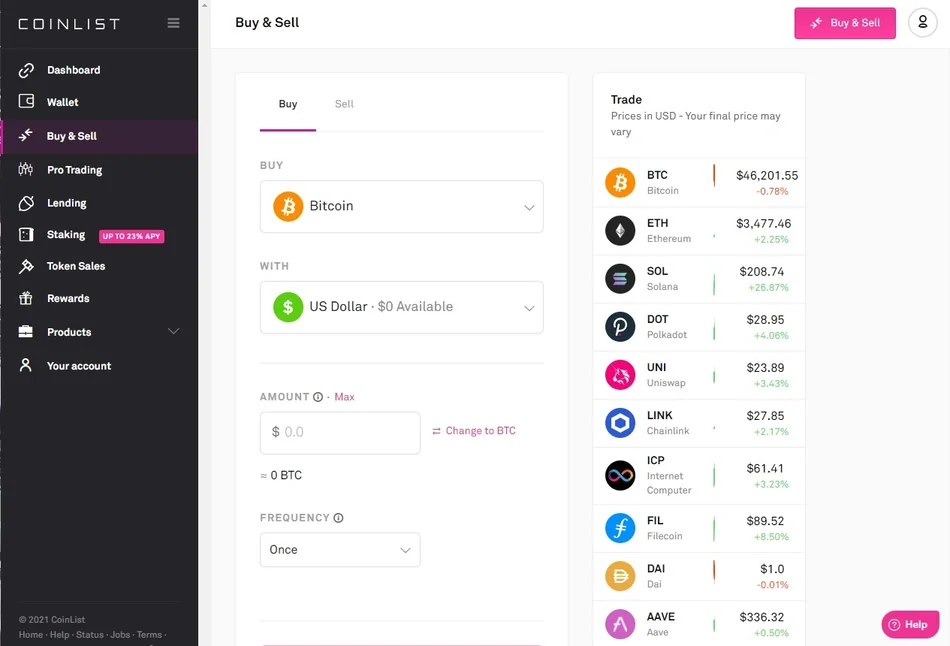

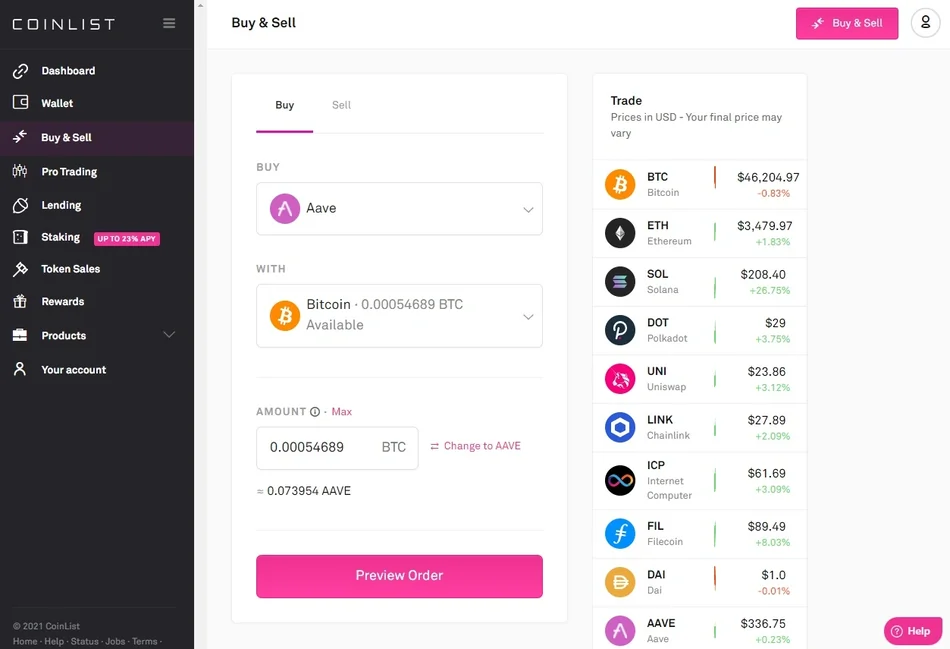

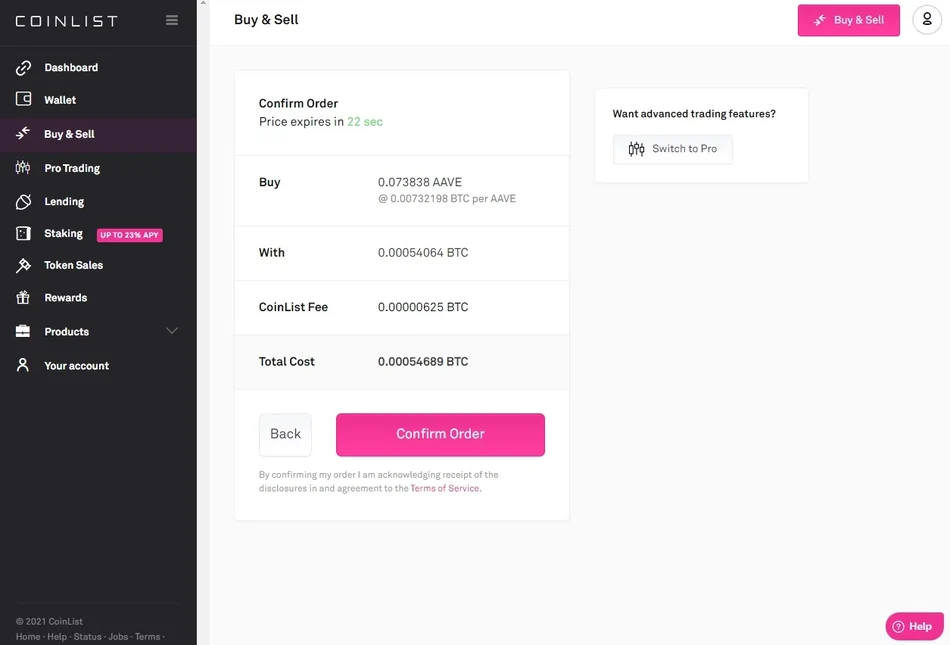

KYC and Fiat-to-Crypto Exchanges

Because they are dealing with fiat money, which is accepted as legal cash by governments, fiat-to-crypto exchanges often complete at least some degree of KYC. Such exchanges are required to transact with banks and other traditional financial institutions, the majority of whom undertake their own KYC prior to transacting with outside parties.

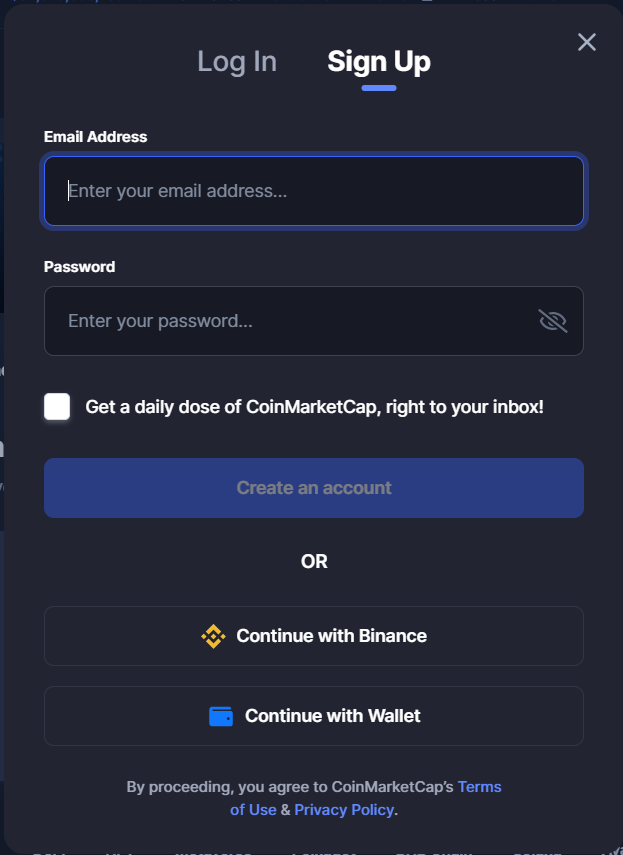

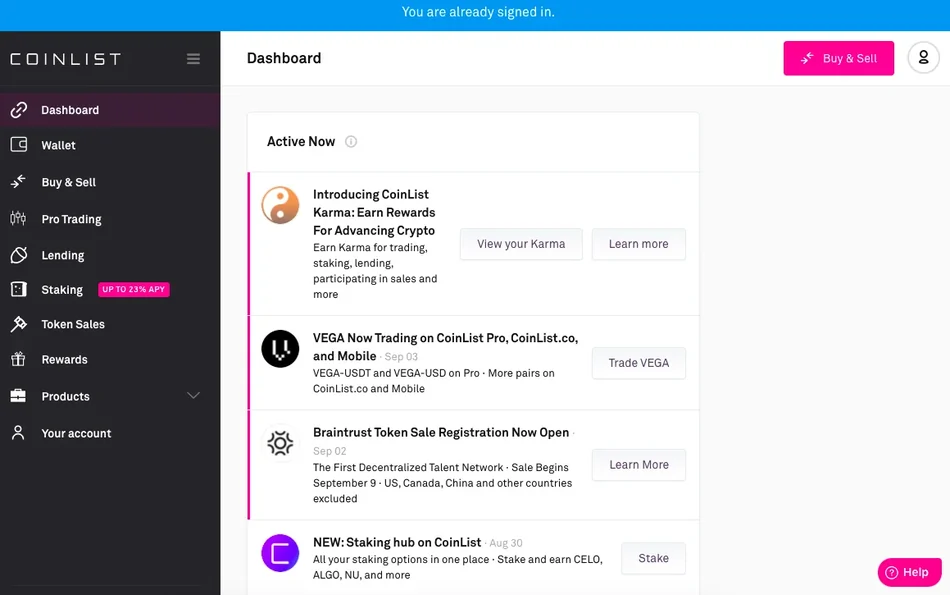

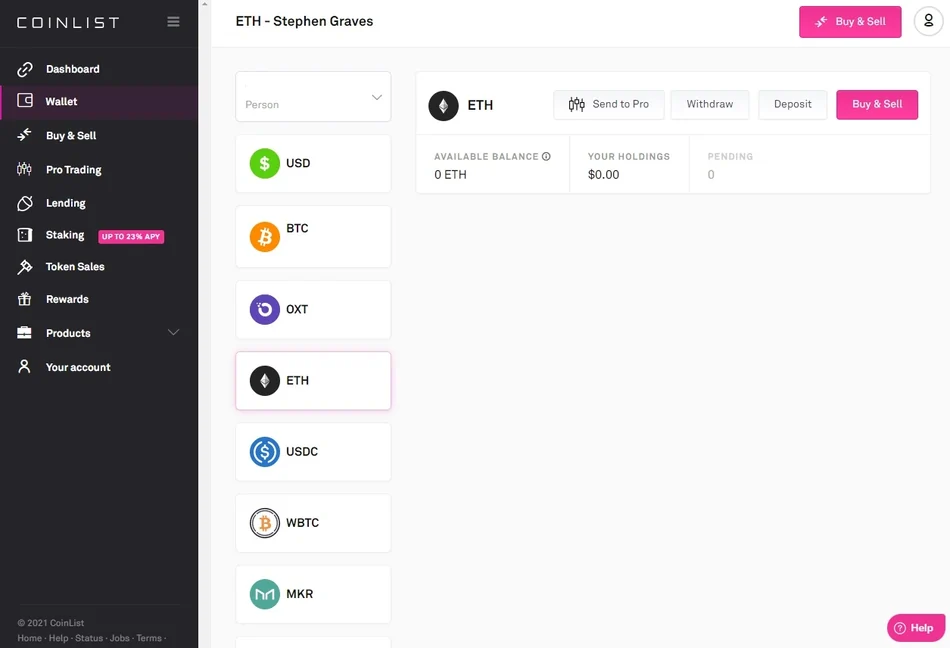

One of the most popular cryptocurrency exchanges in the world, Coinbase just needs a user to register an account with a name, email address, and password in order for them to deposit and swap their existing crypto assets. However, in order to acquire or sell bitcoin, you must undergo thorough KYC verification.

AML vs. KYC

AML is a well-known phrase that is often used in conjunction with KYC in the cryptosphere. I’m here to warn you that although though these two acronyms are frequently used interchangeably, they shouldn’t be. AML and KYC are quite unlike to one another.

The link between KYC and AML may be viewed as such: “Know Your Customer” is a collection of requirements that are included inside the much larger, more general category of Anti-Money Laundering legislation. In essence, KYC is one of the primary specialized components that fall under the umbrella term of AML.

AML isn’t really important in terms of crypto. The idea of AML is primarily associated to bigger and more established financial institutions, however there are exchange platforms that do follow certain severe AML-related norms and regulations (Binance KYC is one example).

Why are AML and KYC crucial to the cryptocurrency sector?

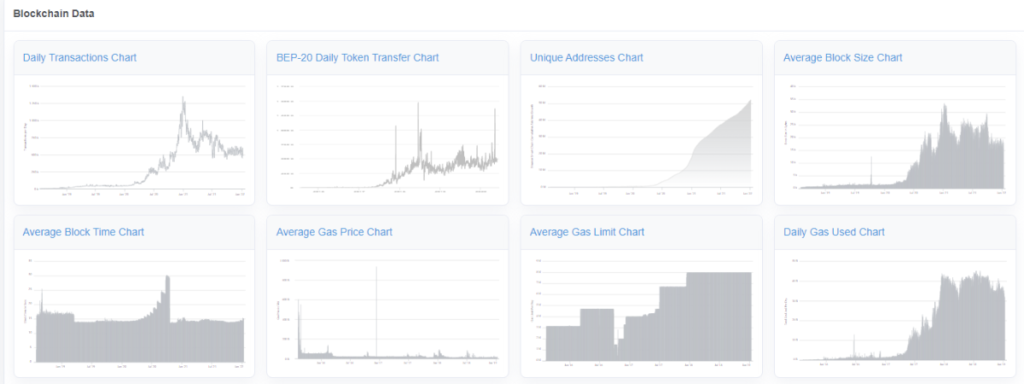

Enforcement of Know Your Customer (KYC) and anti-money laundering (AML) laws benefits VASPs and their end-users. Virtual currency as an asset class lacks a sound regulatory structure, in contrast to fiat money. The source and destination of some evil actors’ financial transactions are sent and hidden on purpose. Money laundering, terrorist funding, and illegal financing may be reduced with the aid of standardizing regulatory standards and conducting KYC and AML checks.

What advantages does Crypto KYC offer?

Cryptocurrency exchanges gain a lot from regulatory compliance despite operational modifications and challenges associated with adopting KYC criteria for the reasons outlined below:

- Customers are more trustworthy and transparent as a result of user identities being verified: Users are more inclined to stick with a cryptocurrency exchange if they have faith that it is taking proactive and preventive steps to safeguard their accounts.

- Less money laundering and scams: According to a 2022 analysis from the top blockchain analytics firm Chainalysis, criminals laundered $8.6 billion in cryptocurrencies in 2021, a 30% rise over the prior year. A thorough identification check may drastically cut down on fraud and boost brand credibility.

- Lessened legal risk: As laws change, organizations may keep current by using strong KYC procedures. Companies may concentrate on boosting conversion rates, accelerating transactions, and ensuring compliance transactions after the implementation is complete. Businesses can also lower legal and regulatory risks by demonstrating KYC due diligence.

- Increased market stability: Because anonymous transactions, which might be suspicious, are common with cryptocurrencies, the market is famously unstable. Increased identity verification in KYC procedures helps the market remain stable and rise in value.