One of the many applications for the revolutionary blockchain technology, which is just a decade old, is non-fungible tokens (NFTs). If you’ve been reading news items about technology, you’ve undoubtedly seen many that describe the selling of NFTs for millions of dollars at a time.

What is a non-fungible token (NFT)?

NFTs, or non-fungible tokens, are bits of information that are kept on the blockchain and stand in for physical or digital assets. In other words, NFTs are special records that show who owns and what information about a particular asset, such a picture, a movie, or an audio file. While NFTs may store information about a variety of other things, these are only the most widespread assets that they now represent.

It is important to explore the distinction between fungible and non-fungible assets in order to properly comprehend NFTs. Fungible assets lack distinctiveness, and one commodity of a given sort can be substituted by the next. Money is one instance. Fungibility, or the idea that one ten-dollar bill should be worth the same as the next ten, is a fundamental principle of sound money. Because of this characteristic, money is more usable as a means of transaction and more predictable.

Contrarily, non-fungible assets are distinct assets whose value is based on their distinctions. Pictures, photographs, and other similar assets are ideal examples of non-fungible assets since they are frequently one of a kind. Due to the lack of a uniform value, these goods would make awful means of exchange as money.

Despite this, they are nonetheless valued because of their individuality, which also contributes to their appeal. The blockchain, where data can be immutably recorded and easily confirmed for authenticity, is the sole platform that NFTs transmit this functionality to.

How do NFTs function?

Since NFTs are supported by several blockchains, there are multiple frameworks that specify how to mint NFTs. NFTs are unique assets that reside on the blockchain. By entering the information about a certain asset onto a blockchain, the process of minting involves producing a brand-new NFT.

The two frameworks (also known as standards) for minting that are offered by Ethereum, the most widely used platform for NFTs today, are ERC-721 and ERC-1155. Another blockchain platform where NFTs may be created is Binance Smart Chain (BSC), which features two standards that are similar to Ethereum’s codenamed BEP-721 and BEP-1155.

Both the two standards that specify how NFTs on respective platforms are issued on Ethereum and the BSC platform function identically. Leading cryptocurrency exchange Binance developed the BSC blockchain, which is similar to Ethereum in terms of capabilities and can handle smart contracts. Cost is the primary distinction between the two networks. On BSC, transactions are significantly less expensive than on Ethereum.

Technically, NFTs may be sent from one person to another on the blockchain much like transmitting Bitcoin (BTC) from one person to the next since they are tokens. They can be kept in a wallet or purchased and traded on an online exchange like OpenSea for Ethereum NFTs or the NFT Marketplace on Binance.

Why you should invest in NFTs

The NFT niche is a growing market, and it has only gotten bigger and more well-known since Cryptokitties made NFTs mainstream, at least within the blockchain community. Regardless of who you are or what your investing objectives are, there are a number of reasons to invest in these digital assets.

There are reasons other than financial gain to invest, but even then, it never hurts to know that there is a potential to make a fortune just by holding one of these rare tokens. The majority of investors entered the NFT market searching for the next best thing in terms of returns on investment (ROI).

Why you would wish to get an NFT right now is as follows:

- Utility: Because NFTs are distinct tokens that are immutably recorded on the blockchain, anybody may use an NFT to demonstrate the legitimacy, worth, scarcity, and provenance of an asset.

- Investing money: NFTs are popular right now since some of these young assets have experienced unheard-of value increases, selling for millions of dollars only a few weeks after being launched.

- Asset protection: The majority of artists have long grappled with issues of intellectual and tangible property, but thanks to NFTs, they now have a weapon that will allow them to not only safeguard their body of work but also get just remuneration.

- Support for blockchain technology: NFTs are among the most prominent use cases for the technology, but even so, the whole cryptocurrency market is still expanding, and the more users engage with the system, the better it will get. By purchasing, offering, or creating new tokens, investing in NFTs may be a terrific way to increase liquidity and support a more active crypto community.

How to Calculate the Worth of an NFT

From an investing standpoint, NFTs have shown to be quite successful, and with an expanding list of functions, more and more individuals are now seeking to purchase some of these assets. However, since the majority of potential investors are unfamiliar with the specialty and the asset is still developing as an investment, estimating an NFT’s worth is difficult.

For instance, there is a high likelihood that an NFT purchased today may have either more or less utility in the future, which might indicate that its present valuation is either under or overpriced.

It’s also difficult to underestimate how important FOMO is in determining how much these NFTs are worth.

It demonstrates that market factors such as supply and demand are applicable to NFTs.

An impartial appraiser or investor will analyze an NFT in one of the following three methods to determine its value:

- Rarity: Compared to their physical equivalents, such as paintings and sports memorabilia, digital treasures are not that much different. They grow more precious as they get rarer. An NFT’s provenance has an impact on its value as well. An NFT made by a well-known digital artist or owned by a well-known person, for instance, may be worth more than one without a noteworthy past.

- Utility: While the majority of NFTs made in the crypto world are done just for amusement, some have been developed with more practical use in mind. For instance, some NFTs grant access to Decentraland’s blockchain-based virtual territory, but other NFTs may be used as in-game currency for games like Gods Unchained, etc. Owners of NFTs may even be able to borrow money utilizing some DeFi (Decentralised Finance) systems by pledging their collections as collateral.

- Liquidity: Although liquidity is a less important component, it nevertheless has the potential to impact an NFT’s value. The ease with which a digital collectable may be created, purchased, and sold is referred to as its liquidity. There are a few obscure blockchain networks where you can mint an NFT, however most networks are not currently compatible owing to the diversity of the blockchain environment. Due to the lack of supporting services, such as a marketplace to advertise the asset, a well-liked wallet to store it, or even finding utility for the NFT, NFTs developed on such tiny networks may be difficult to distribute, acquire, or sell.

How to get into NFT investing

NFTs could be a brand-new phenomena that is only starting to take off in the IT and blockchain world. There is no reason why you should be one of the investors who are only learning about it now as it develops.

Everyone has to start somewhere, and if you want to profit from this incredibly lucrative field, here are some steps you can follow to go from being an absolute novice to an expert in non-fungible tokens.

Get informed: The greatest method to comprehend the what, how, why, where, and when to invest based on your financial goals is to get information about a certain asset class. NFTs are no different, and given their novelty, it is imperative to invest the time to research and comprehend how to develop an NFT, purchase and sell it for a profit, or even employ it in any other method that may be feasible.

Select Your NFT Market: Markets are locations, either real or virtual, where products and services are exchanged. NFT marketplaces are online markets where non-fungible tokens may be traded, with some of them also providing the ability to produce new NFTs. The NFT Marketplace on Binance, OpenSea, Nifty Gateway, and Rarible are a few examples of popular NFT markets. The best marketplace for you will depend on your specific demands, such as whether you want to manufacture NFTs or only trade them. Marketplaces provide a variety of options. Which marketplace you choose to utilize may also depend on the blockchain on which you wish to generate your NFTs. To trade and mint NFTs within the Binance ecosystem, for instance, the Binance NFT market is suitable.

Select your cryptocurrency wallet: If you want to invest in NFTs, you must have a cryptocurrency wallet because they are essential tools for communicating on the blockchain. There are a variety of wallets available, each with a different set of functions. We advise you to investigate and test out the various wallets, although Metamask and Trust Wallet are the most well-liked options for NFTs connected to Ethereum and BSC, respectively.

Purchase cryptocurrency: The final step is to purchase some cryptocurrency, which is necessary for producing or purchasing NFTs. You will require Ether (ETH) currency in order to generate a non-fungible token on the Ethereum network. The same is true for BSC NFTs, where Binance Coins are necessary (BNB). The majority of systems that enable NFT minting will demand that the creator utilize the native cryptocurrency of the blockchain to pay for fees to mint the NFT.

How to Purchase and Exchange NFTs on the Binance NFT Market?

The procedure for purchasing and selling an NFT is frequently easy to understand, however this may be heavily influenced by the trading platform you decide to use.

We’re going to use the Binance NFT exchange to keep things simple. The Binance platform is simple to use and integrates well with the current Binance ecosystem. Users are spared from having to establish and manage many accounts to meet all of their cryptocurrency-related demands.

Your Binance login information is all that is required to access the Binance NFT marketplace. So, if you haven’t already, register a Binance account before continuing with the instructions. After establishing the account, be careful to finish the identity verification process.

How to Buy NFTs

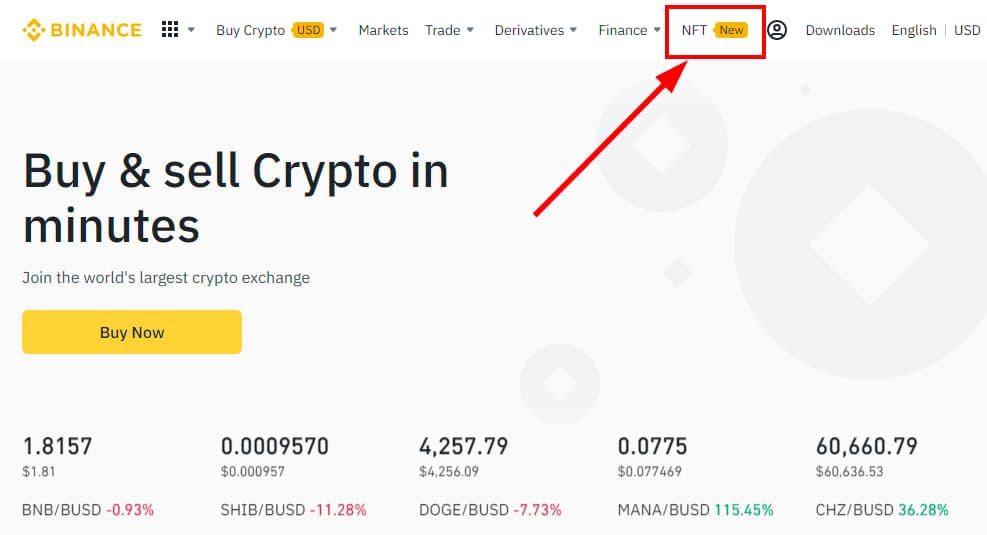

Go to the Binance homepage and choose NFTs from the top menu. You will arrive in the Binance NFT market after taking this action. As an alternative, you can go straight to the market by going to the Binance NFT Marketplace website (https://www.binance.com/en/nft/market).

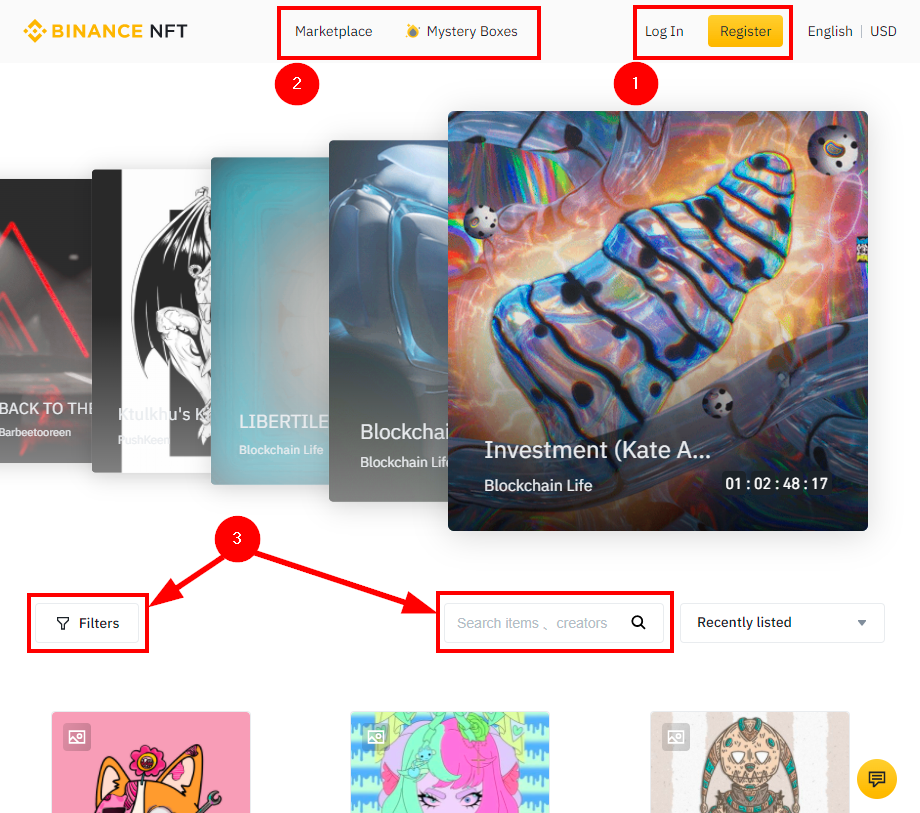

Upon logging in to your Binance account, go to the marketplace to buy an NFT or the Mystery Boxes area to purchase a mystery box that contains an illegible NFT.

Scroll down the marketplace site to search for the NFT you’re after using either the usernames of the makers or the titles of the items. You may use the filters to narrow down your search on the left side.

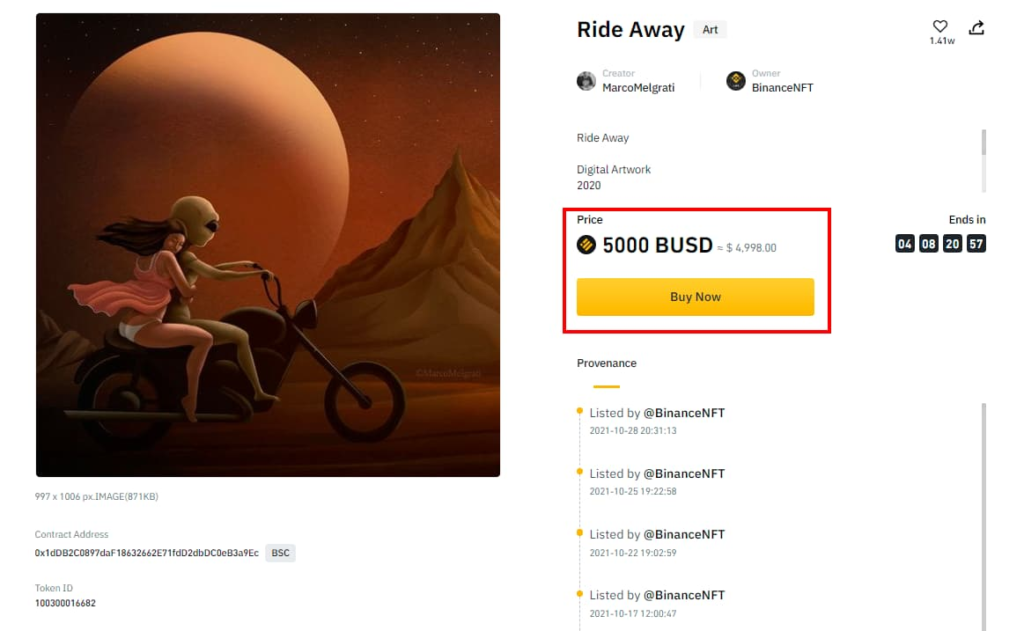

Select the NFT that you want to purchase and click it to read more about it.

Depending on the choices the vendor offers, you may decide whether to buy immediately or place a bid on the NFT.

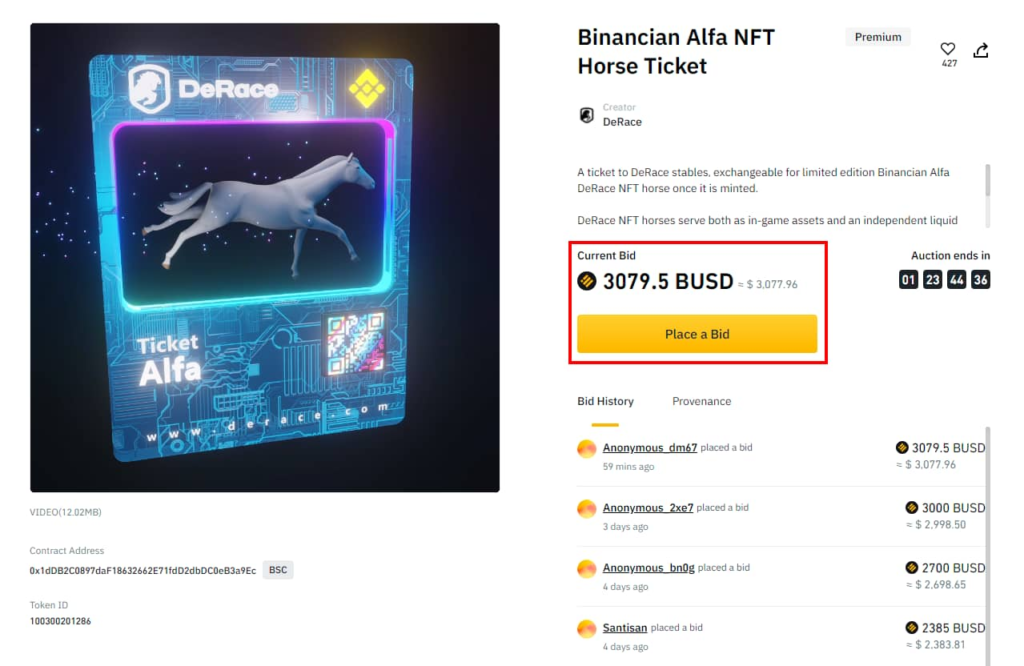

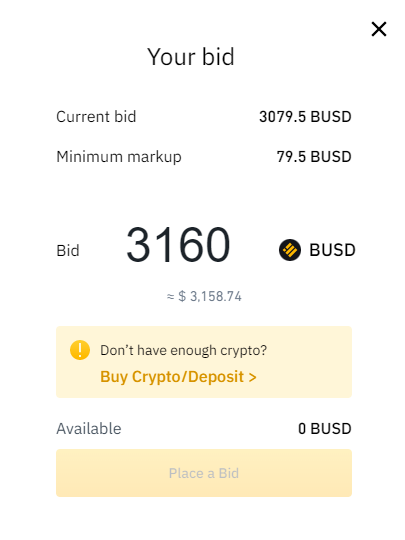

Click on the [Place a Bid] button to submit your bid if you choose to participate in the auction system.

You may use the funds in your Fiat & Spot wallet to make NFT purchases on the Binance NFT Marketplace. There are three supported currencies: BNB, BUSD, and ETH. The Binance stablecoin BUSD is linked to the US Dollar as a reserve currency.

Click [Place a Bid] after putting your one, and it will appear above all other bids until another bid is made. If your bid remains the highest at the conclusion of the auction period, you will be recognized as the NFT’s purchaser, and Binance will automatically deduct the bid amount from your account.

The NFT will be put into your wallet, where you may sell it, retain it in your NFT collections, or transfer it to any other wallet.

How to Sell NFTs

You may now sell or trade your NFTs on the Binance NFT Marketplace once you have acquired them by minting or purchasing them from a marketplace. Here’s how to go about it:

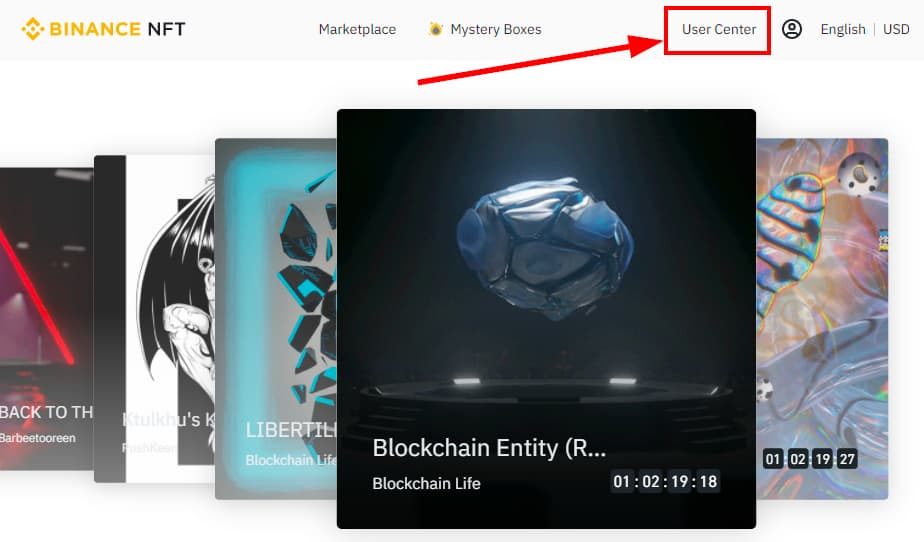

By selecting [User Center] from the top navigation menu bar, you may access the Binance NFT user center.

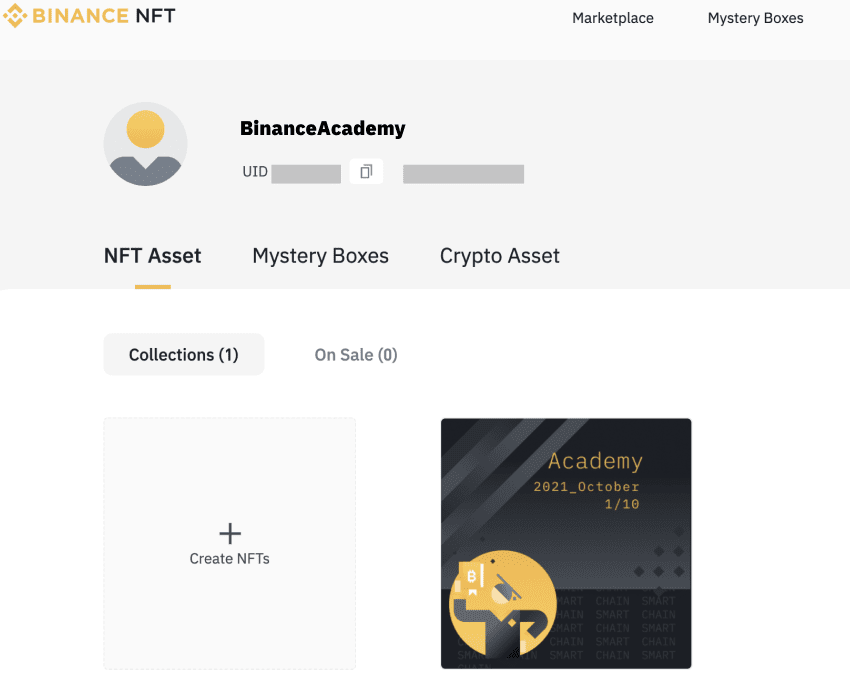

Choose the NFT Asset, Mystery Boxes, or Crypto Asset among three alternatives to sell the asset you want. Pick the first choice when selecting an NFT asset.

Collections and On Sale are the two tabs available under the NFT Asset tab. The former will display all NFT assets that are currently listed on the market, while the latter will display all NFT assets that are currently listed.

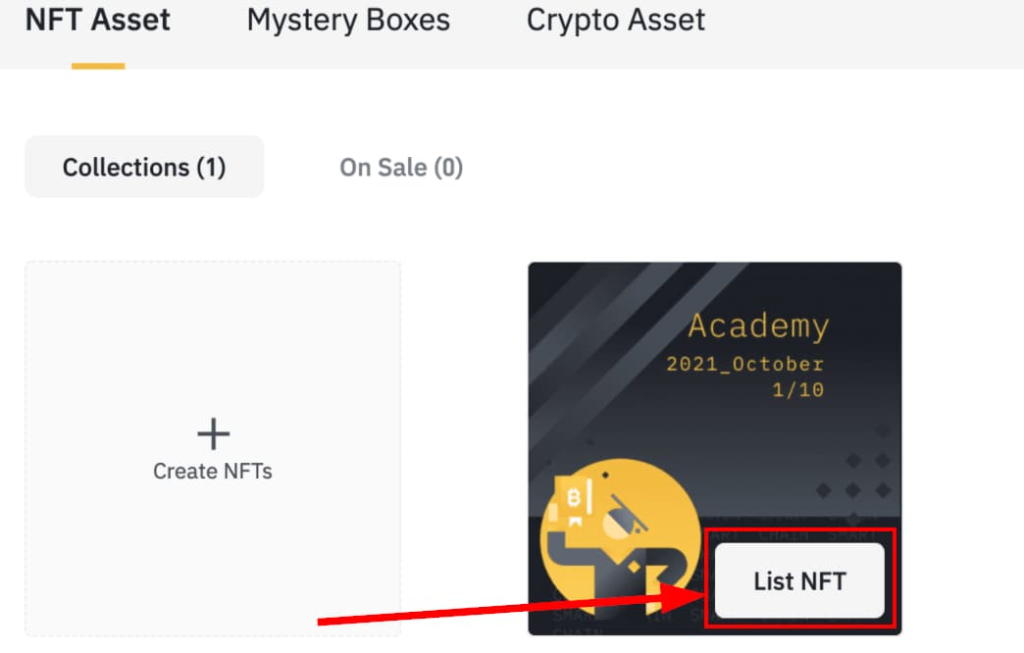

Select the asset you want to sell by hovering the mouse over it, then click the [List NFT] button that appears on the lower side of the thumbnail, then select [Collections] to add a new asset.

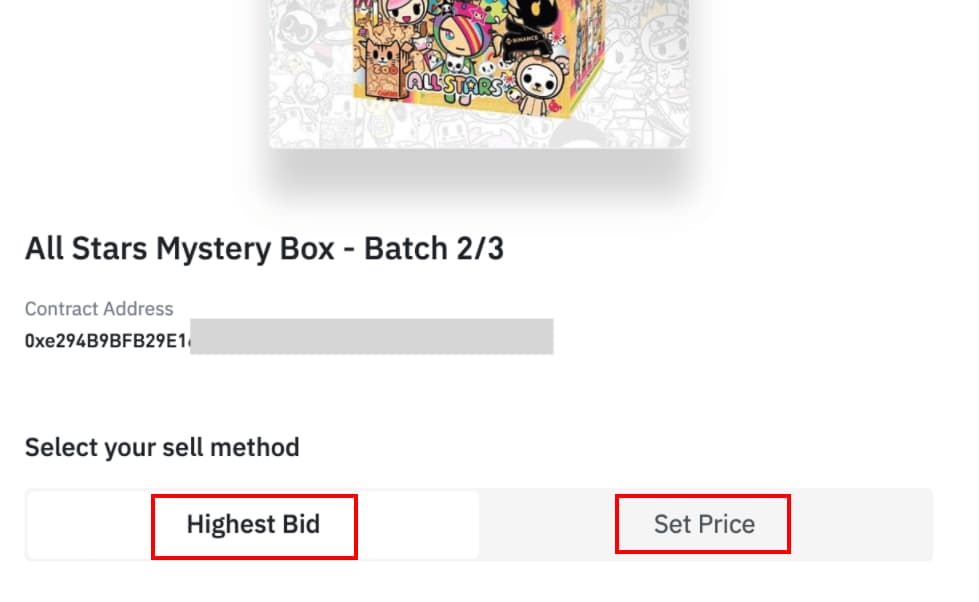

Select whether you want to sell your item for a specified price or at an auction. For the first option, choose [Highest Bid], and for the second, choose [Set Price].

If you want to sell the item at auction, you must include the beginning bid amount as well as the day and hour the sale will end. Similarly, if you are selling the asset, you may indicate the asking price and the duration during which it will be up for grabs on the market.

Only at the minting or creation stage are asset descriptions added. Only the price and the selling method may be chosen at the listing stage; the NFT’s characteristics, including its artistic origin, cannot be altered.

Put the NFT forward for listing. You must read and comprehend the terms and conditions of listing an NFT on the market after giving all the listing information. Once you have read and agree to the terms of service, click the [Submit] button to make your asset available to potential purchasers on the marketplace.

Due to the increasing prices the assets are fetching, NFTs are a fascinating and exciting fresh blockchain use case that is now gaining a lot of attention. Although the procedure for buying and selling an NFT may appear difficult, we have demonstrated that it may be straightforward depending on the platform you select.

The Binance NFT marketplace comes highly rated and offers a number of benefits, including the ability for users to generate NFTs directly from their account and support for Ethereum NFTs. Furthermore, because Binance has a sizable ecosystem, NFTs generated there could be more useful there than if they were minted elsewhere and then sent to Binance.