The U.S. back in March 2022 In what is regarded as the DOJ’s first NFT “rug pull” bust, Ethan Nguyen (a.k.a. “Frostie”) and Andre Llacuna (a.k.a. “heyandre”), the co-founders of Frosties, were charged with conspiring to conduct fraud and conspiring to launder money.

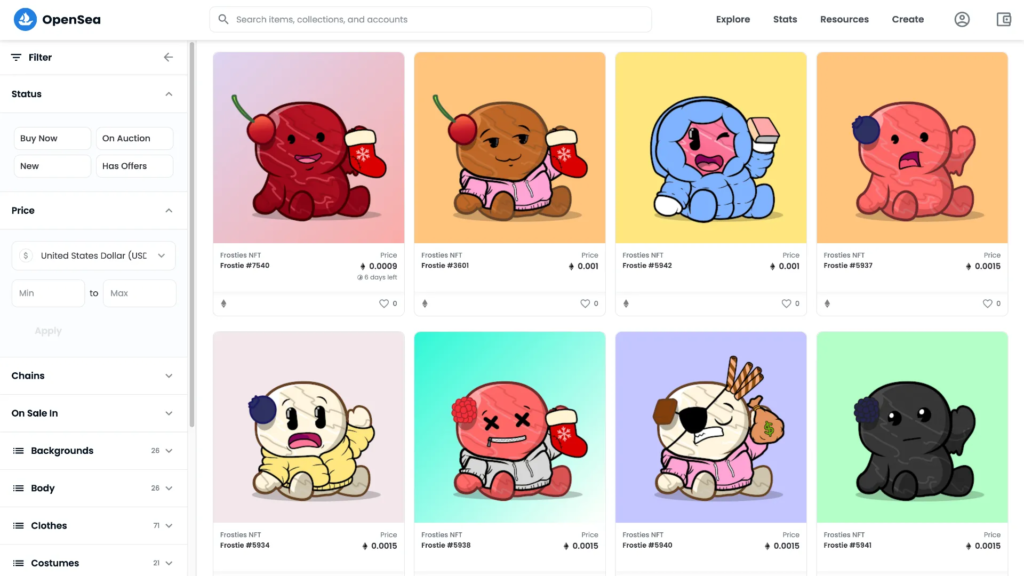

The jig was up for Frosties and its creators after the DOJ’s $1.1 million NFT raid. Investors were also promised raffles, merchandise, and a “special fund to maintain the sustainability of the Frosties,” but these promises weren’t precisely kept for the ice cream-themed project, which was widely pushed as a “cool, tasty, and unique” collection of 8,888 NFTs.

Nguyen, 20, and Llacuna, 20, were detained and charged in the Southern District of New York after a two-month investigation for “promising investors the benefits of the Frosties NFTs, but when it sold out…pulling the rug out from under the victims, almost immediately shutting down the website and transferring the money,” according to the press release. Does Frosties, however, retain the record for the worst NFT ever? No, it’s not the only one that has caused folks to wonder, “Are NFTs a scam?”

Cryptocurrency scam is nothing new. Regulators and investors have been plagued by them as as early as 2017. Rug pulls are only the most recent scam scheme, but they have had negative effects. NFT rug pulls caused more than $2.8 billion in losses in 2021, according to Chainalysis, representing for 37% of the total income from cryptocurrency scams throughout the year and a 1% rise over 2020.

Lawmakers, administrators, and members of the cryptocurrency and NFT communities have been obliged to exercise extreme caution and vigilance when it comes to new projects as user numbers continue to soar. Right now, you need to understand what NFT and cryptocurrency rug pulls are and how to safeguard yourself if you want to be a part of the NFT ecosystem. Here is all the information you require.

What is a “Rug Pull?”

In a malicious act called a “rug pull,” which is akin to a “pump and dump” scheme, cryptocurrency developers entice early investors and then abandon the project by either (1) fleeing with the project funds or (2) selling off their pre-mined holdings, with the goal of draining all funds from investors.

In most cases, the developers will immediately move the money out of the ecosystem once the prices reach a specific threshold and vanish altogether. For instance, the criminal complaint claims that Nguyen and Llacuna moved all of the sales revenues to other digital wallets after receiving over $1 million in cryptocurrency from their community. They also allegedly shut down the project’s website and Discord server. Investors in the initiative were unable to contact the creators and never received the promised benefits.

Nguyen and Llacuna now each face a 20-year jail sentence.

It is an awful typical circumstance, and this type of crypto fraud is not new. Although the DOJ’s recent bust of Nguyen and Llacuna is not the first “rug pull” to target both novice and experienced investors in the NFT market, it is a first. As a result, the incident undoubtedly brings up many new issues about the judicial system. However, in order to fully comprehend the legal implications of this incident, we must first take a closer look at this particular crypto and NFT fraud. However, the Frosties NFT rug drew a strong response from American legal systems, which many saw as the beginning of the end for crypto and the NFTs’ reputation as an online Wild West.

As a result, further inquiries concerning the judicial system surfaced. The Frosties case should deter copycats from trying to replicate the fraud given the high-profile arrests of other bad actors in the crypto and NFT areas. Our laws may need to catch up, even as federal officials are keeping a closer check than ever on Web3 for wrongdoing. We must go a bit deeper into the nature of this specific type of crypto and NFT fraud in order to comprehend the legal importance of this incident.

Are cryptocurrency and NFT rug pulls prohibited?

The first thing to consider is whether NFTs adhere to stricter standards than other forms of investments due to their recent emergence in the fintech industry.

Naturally, the response is no.

According to Special Agent-in-Charge Thomas Fattorusso’s remark from March, “NFTs represent a new age for financial investments, but the same regulations apply to an investment in an NFT or a real estate development.” “You cannot ask for money for a business opportunity, run away with the money the investors gave you.”

Given the horrifying repercussions that victims inevitably experience in whatever case, the next thing to raise is whether rug pulls are criminal. Most attorneys will concur that the answer to that question relies on the form the rug pull takes at the time it’s happening as they increase their legal expertise as it relates to NFTs.

What types of rug pulls are there?

Hard rug pulls

Which can place when a project’s founder intentionally utilizes the project as a tool to mislead investors by using coding, are wholly prohibited. In this instance, the smart contract has concealed clauses in its code that are intended to deceive investors and steal money. The code is prima facie proof of the intention to defraud investors and steal their money, usually by locking them into an asset with no real direction or purpose.

Soft rug pulls

Are generally despised in the NFT area despite the fact that they aren’t technically “illegal” per per. When word got out that the creator of Azuki had given up on earlier endeavors, many people dreaded a future Azuki rug pull. What distinguishes a soft rug pull from a firm rug pull, then? It’s not overt, but it’s obvious: there’s still a chance that the smart contract code was created with the intention of stealing from or defrauding investors.

The majority of the time, this happens when founders and their teams quickly liquidate their assets, depreciating the token in the process and taking advantage of the profit made by investors purchasing the cryptocurrency itself. As an illustration, consider a cryptocurrency initiative that claims to contribute money but decides to keep it for whatever reason.

The DOJ has proven time and time again that it isn’t one to play around, most notably with its recent Frosties NFT bust. The National Cryptocurrency Enforcement Team’s director, Eun Young Choi, was revealed by the Justice Department to be its first-ever appointment in February (NCET).

The NCET, which is made up of attorneys from across the department and includes prosecutors with experience in cryptocurrency, cybercrime, money laundering, and forfeiture, was established, according to the press release, to ensure that the department is up to the challenge posed by the criminal misuse of cryptocurrencies and digital assets.

With a focus on virtual currency exchanges, mixing and tumbling services, infrastructure providers, and other organizations (NFT projects), Choi’s role as NCET Director will enable her to identify, investigate, support, and pursue the department’s cases involving the criminal use of digital assets.

Despite the fact that there is presently no formal legislation governing NFTs, there are still methods to hold people legally accountable and bring them to justice, particularly for fraud, money laundering, and of course conspiracy to conduct fraud and money laundering.

The DOJ stated it had confiscated roughly $3.5 billion in bitcoin after arresting couple Illya Lichtenstein and Heather Morgan on suspicion of laundering it one month after Choi was appointed and NCET was founded.

Frosties should serve as a clear reminder to everyone that regulators are closely monitoring NFTs and that the federal government is still able to use its resources to unravel complicated transactions and assist in identifying offenders who try to hide their identities, contrary to what many people believe about the federal government’s lack of the necessary resources to handle criminal acts of this magnitude with this new form of technology.

The SEC and regulators keep a careful eye on everything

The size of the NFT market has nearly doubled, exceeding last year’s figure of $25 billion, and is now estimated to be worth over $40 billion, including everything from artwork and antiques to gaming assets and virtual real estate.

As a result, it should not be surprising that the Securities and Exchange Commission (SEC) has apparently begun speaking with NFT developers and specific NFT markets that sell them to determine whether or not NFTs are being used in a manner that violates U.S. securities legislation. Despite the SEC’s prior expertise in the regulation of markets, Web3 has presented a fresh set of particular difficulties.

In accordance with the influential U.S. According to the Supreme Court case Howie, transactions that fall under the category of “investment contracts” are subject to U.S. securities laws if they (1) entail the investment of money in a joint venture and (2) a reasonable expectation that gains would result from the labor of others.

The entire crypto community is perplexed as to how the SEC will approach its initial attempts at rulemaking as it continues its investigation to better understand digital assets. Chairman Gary Gensler has made it clear that the agency will focus its attention on taking greater oversight of cryptocurrency.

So, do you need to fear? No, unless you want to start your own fraud business. Understanding how the main participants in the markets operate is the first step in the SEC’s efforts to regulate cryptocurrencies and NFTs. The Bored Ape Yacht Club made headlines in October 2022 when it was discovered that the SEC was looking into it. Contrary to con artists like Ethan Nguyen and Andre Llacuna, the BAYC welcomed this information and complied fully with the SEC’s investigation. Moving ahead, it would be advantageous for everyone if the NFT industry and regulatory organizations like the SEC could cooperate.

In the end, make sure you have spoken with a lawyer or at the very least have one available to you before choosing to invest in any cryptocurrency or NFT enterprise. It never hurts to have an extra set of eyes to assist you be vigilant, watchful, and diligent.

Make sure the project has a “story” or heart that gives it purpose, direction, and a clear roadmap of where it’s heading when you consider various NFT initiatives to invest in. Without them, all you are doing is betting on the future and putting yourself in danger of losing everything.

Legal professionals may have been compelled to take on greater ethical obligations as a result of the rising use of digital assets, particularly NFTs, in order to effectively and zealously defend clients. Naturally, this calls on them to at least have a basic understanding of the market to engage in those discussions regarding digital assets with their clients.