CoinList simplifies the process of purchasing, selling, staking, and lending cryptocurrency. Here’s how to get started with the cryptocurrency adoption-promoting platform.

The goal of CoinList is to hasten the adoption of cryptocurrencies. To that purpose, the cryptocurrency platform has created a comprehensive user experience, incorporating everything from loans to trading tools. Users may purchase, sell, stake, and lend the trendiest new crypto assets using the multi-service platform.

What exactly is CoinList?

CoinList, a cryptocurrency marketplace, has gained notoriety for granting quick access to digital assets before they list on other hugely popular exchanges.

As a market pioneer in new token issuance, CoinList has facilitated communication between tens of thousands of new token holders and high-profile projects including Filecoin, Solana, Celo, Algorand, Dapper, Blockstack, Mina, and Casper. Additionally, they now support the whole cryptocurrency lifecycle, including token sales, distribution, trading, lending, and staking.

What is offered on CoinList?

CoinList rigorously vets projects, so the selection on its platform is carefully curated. There are around 40 cryptocurrencies currently available to purchase or trade, including many emerging assets that have yet to hit the wider market.

Introduction to CoinList

It doesn’t take long to sign up for CoinList. Visit the registration page and fill out the necessary information. Your email will contain a verification link from CoinList; once you click it, you’re in!

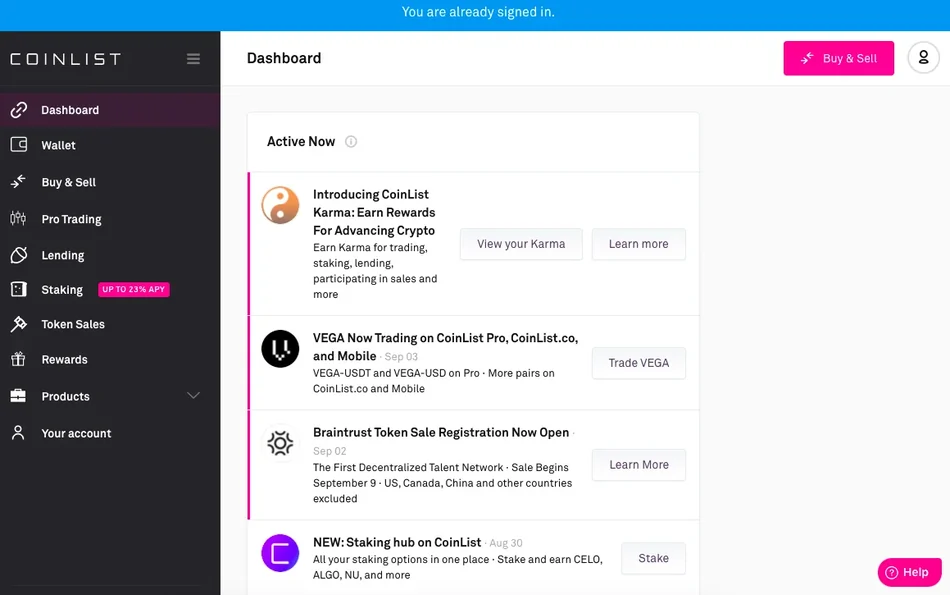

How to Invest on CoinList

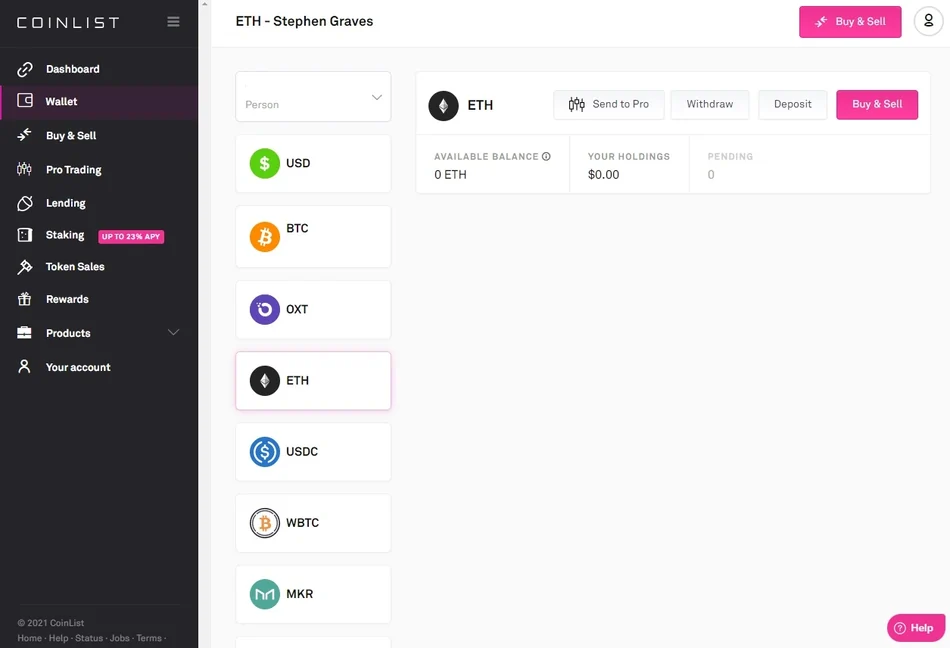

You must first fund your wallet before you can begin purchasing, selling, and trading cryptocurrency on CoinList. Once you have logged in, select “Wallet” from the left-sidebar menu. The US Dollar, the first item on the list, will be selected by default (USD). To make a deposit, click the “deposit” button. The next step is to connect a bank account (using the Plaid service) or send a wire transfer using the information supplied. It’s crucial to include the Memo field in the wire transfer exactly as specified.

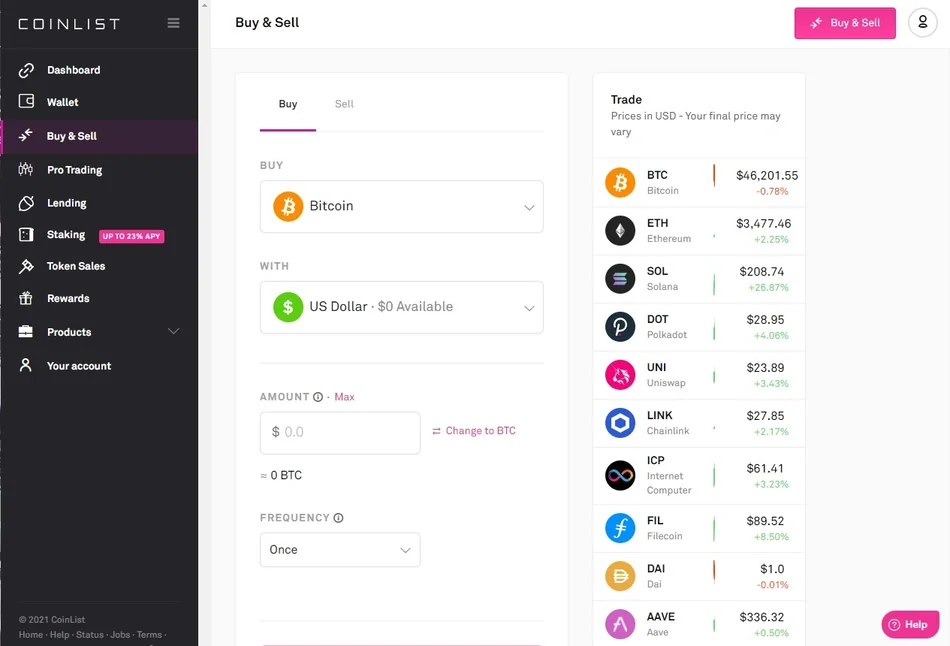

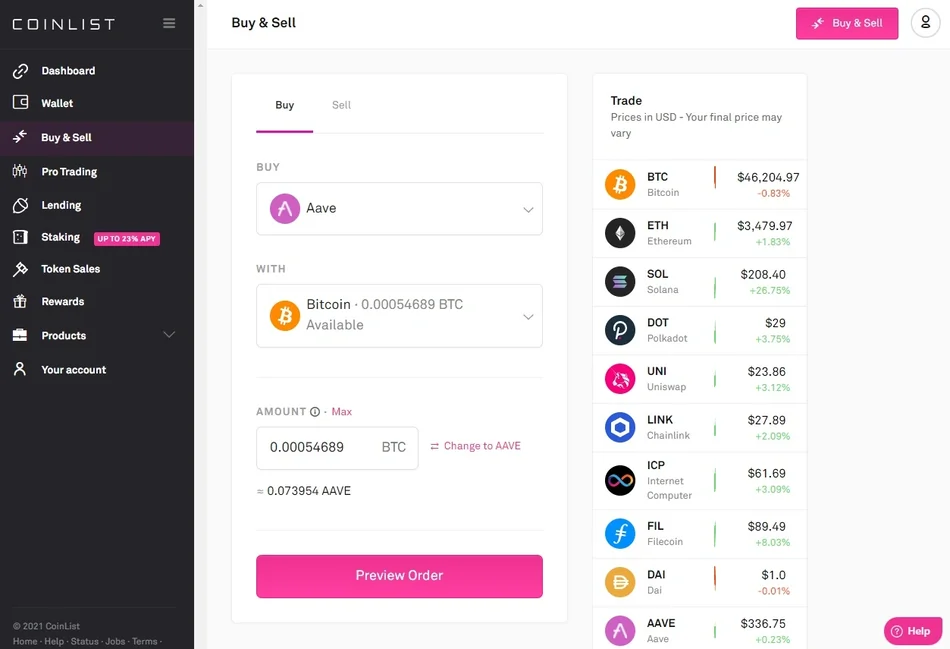

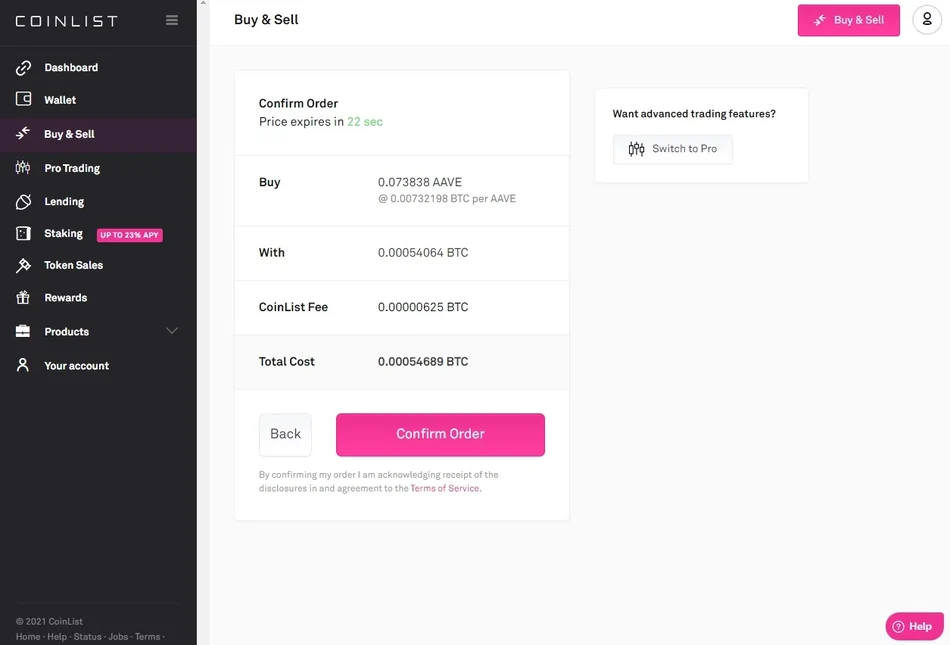

Once you’ve added some USD to your account, you may start purchasing cryptocurrency. Simply go to the “Buy & Sell” page using the left sidebar, then choose your preferred cryptocurrency from the drop-down option. If you’re comfortable with the transaction, click “Confirm Order,” and the cryptocurrency should appear in your wallet once you enter the amount you’d want to buy and click “Preview Order.”

Additionally, you may add cryptocurrency to your wallet from another location by going to the “Wallet” tab and selecting your preferred cryptocurrency. You need to copy the CoinList wallet address from the website and proceed as normal when transferring cryptocurrency from your preferred wallet or exchange. Click the “deposit” button and follow the instructions on the page.

You may actively trade cryptocurrency on CoinList in addition to purchasing and keeping it there. Simply go to the “Buy & Sell” tab, choose the two assets you want to exchange, and input the trade amount. To see the specifics of your order, click “Preview Order.”

Click “Confirm Order” if you’re satisfied, and your assets will exchange very instantaneously, with your wallet updating to show the updated token amounts. There are only certain asset kinds that you can exchange.

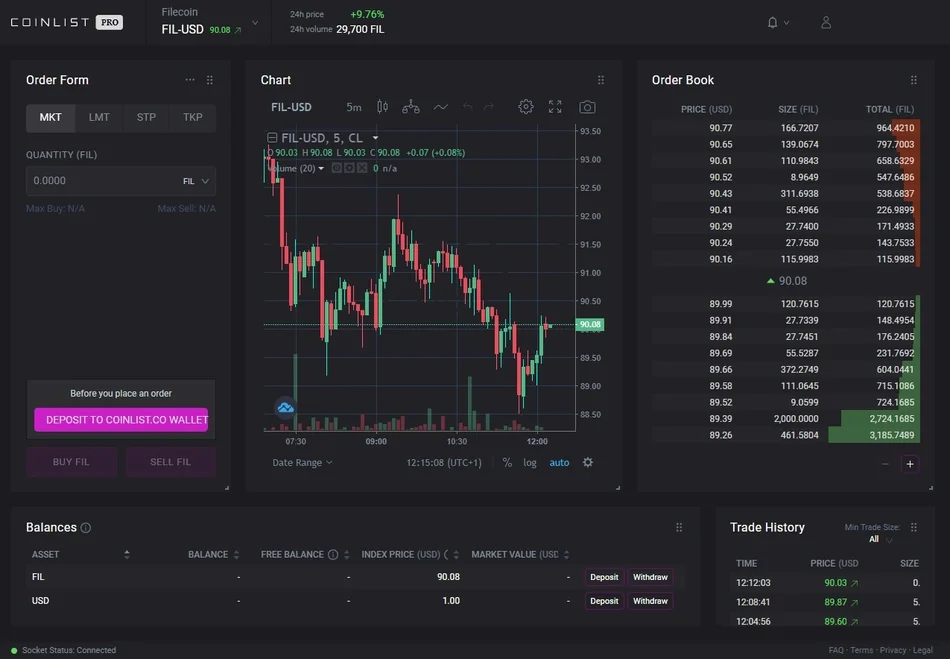

Users with more experience may alternatively go to CoinList Pro, which provides a larger selection of trading tools including limit and stop orders.

How to Place a stake on CoinList

Cryptocurrencies like Bitcoin and Dogecoin are secured by mining (proof of work), while many more recent ones employ a different consensus process called proof of stake (PoS). With PoS, staked money is used in place of mining and the costly hardware needed for it.

Stakers commit their crypto assets to the network in exchange for a portion of the network rewards in order to assist the blockchain in validating transactions.

Technically challenging and expensive, staking can be a labor-intensive operation. By eliminating that complication, CoinList makes staking for consumers a straightforward procedure. Since you have the option to opt out, unless you specify otherwise, your assets kept on CoinList will automatically be staked for you.

The only prerequisite for staking on CoinList is owning the necessary assets.

Currently, users of CoinList may stake FLOW, MINA, CSPR, NU, CELO, and ALGO (US users are restricted to staking NU, CELO and ALGO).

You must first purchase an asset or put it into your CoinList wallet in order to stake it on the platform. For more information, see the section above on “how to trade.” Once your cryptocurrency is in the CoinList wallet, staking may start!

Like all other intermediary validators out there, CoinList doesn’t charge users to stake, but it does levy a fee on the benefits that users receive for staking.

Rewards differ by asset and change based on the blockchain network’s circumstances. The more individuals who stake an asset, the less lucrative it gets.

You have the option to opt out if, for whatever reason, you don’t like the concept of staking.

How to lend on CoinList

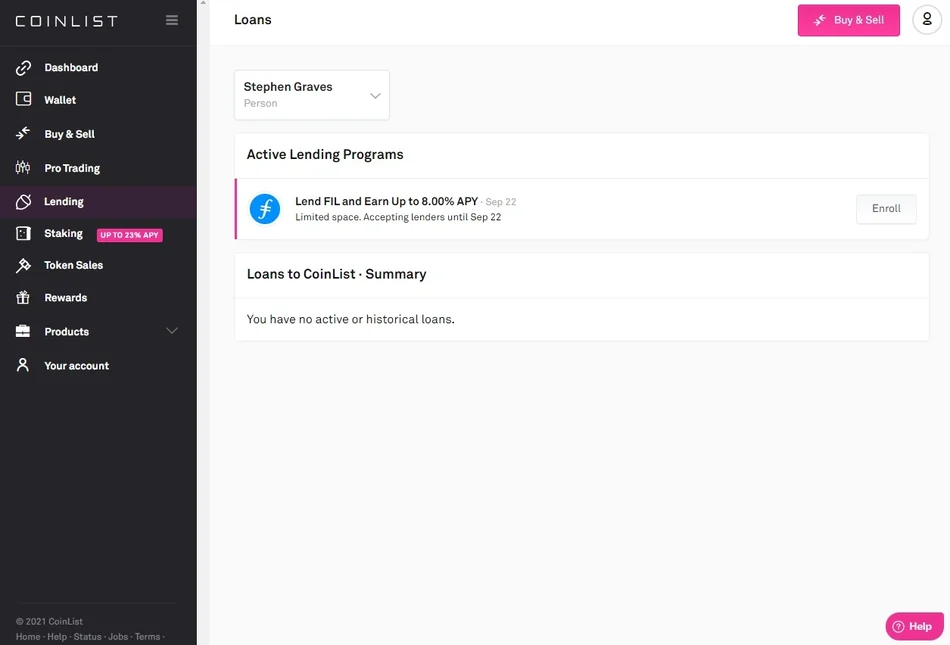

Users of CoinList may lend cryptocurrencies and get a fixed interest rate on certain assets (at the moment, lending is limited to Filecoin).

On CoinList, lending only takes a few mouse clicks.

Click “loan” on your dashboard, and a list of the current programs will appear. Prior to participating in a loan program, you must fulfill the program’s conditions, which include presenting picture identification and (for U.S. users) your social security number. Programs also provide important information like the minimum crypto requirements and the length.

Simply click on it and enter the desired loan amount once you’ve found a program that you like and that meets the minimal conditions. You will get the original capital plus any accrued interest back at the conclusion of the lending period. Keep in mind that lending implies you cannot access your money while it is being borrowed.

Keep an eye on when CoinList begins receiving the subsequent batch of the asset you wish to lend as these are time-limited programs.