A cryptocurrency called Solana was created to function similarly to Ethereum and to enhance it. Software engineer Anatoly Yakovenko came up with the name Solana, which is taken from a tiny seaside community in Southern California.

The novel blockchain was initially put up by Yakovenko in 2017, and Solana was introduced in March 2020. It has swiftly gained popularity and is currently among the top 10 cryptocurrencies in terms of market valuation.

In recent news, a cyberattack on August 2 affected the Solana ecosystem. Blockchain analysts and cryptocurrency investors claim that SOL tokens from Solana, also known as SOL, were stolen from Slope, Phantom, and TrustWallet due to a compromised private key. The users of these “internet-connected” wallets claimed that their money had been stolen.

After a study by developers, ecosystem teams, and security auditors, it appears impacted addresses were ever generated, imported, or used in Slope mobile wallet programs, according to a tweet from Solana Status, which is maintained by the Solana Foundation. Hardware wallets used by Slope are still secure because this vulnerability was limited to one wallet on Solana. Private key information was accidentally sent to an application monitoring provider, while the specifics of how this happened are still being investigated.

According to accounts, more than $6 million worth of digital assets were taken, however damage estimates vary.

What Is Solana?

Solana, a rapidly expanding blockchain that is sometimes referred to as a “Ethereum killer,” bears remarkable parallels to Ethereum.

The SOL coin may be bought on most significant exchanges, much like Ethereum. The Solana network, which offers special benefits, is where the token’s true value lies in transactions.

The proof-of-history consensus algorithm is used by the Solana blockchain. The following block in Solana’s chain is determined by this technique using timestamps.

A proof-of-work method is used by the majority of early cryptocurrencies, including Bitcoin and Litecoin, to determine the blocks in their chains. The consensus method used by proof of work relies on miners to choose the next block.

However, this proof-of-work system consumes a lot of resources and operates slowly, which consumes a lot of energy. This is one of the motivations for Ethereum’s impending Merge, which will see the network switch to a proof-of-stake architecture.

Proof of stake, as opposed to the previous proof-of-work system, employs staking to choose the next block. Until validators agree on the next block of the chain, staked tokens are kept by the blockchain as collateral.

Solana employs “a blend of time-tested cryptographic algorithms and innovative ideas to overcome the flaws of crypto’s first-wave solutions,” claims Konstantin Anissimov, chief operating officer of cryptocurrency exchange CEX.IO.

Solana’s primary goal was to address Ethereum’s scalability difficulties, which it accomplished because to its distinctive blend of proof-of-history and delegated proof-of-stake algorithms. A variant of the more conventional proof-of-stake method is called delegated proof-of-stake.

For those who need a refresher, the proof-of-stake method is a series of transactions that uses a validator system to add new blocks to a blockchain.

Solana’s delegated proof-of-stake method benefits consumers in a number of ways.

According to Christian Hazim, an analyst at ETF supplier Global X, the history algorithm offers an additional degree of protection to the network.

Solana essentially resolves two of the three problems Vitalik Buterin, co-founder of Ethereum, mentioned in his blockchain trilemma of scalability, security, and decentralization.

Most experts feel that the network only handles two parts of the trilemma—security and decentralization—despite the fact that Buterin initially stated Ethereum would cover all three of its components.

But Solana is made to handle both the security and scalability sides of the trilemma. SOL’s proof of history technique offers the network with exceptional security. While the Solana platform’s improved scalability is made possible by how quickly calculations are performed.

What Sets Solana Apart?

Anissimov claims that Solana delivers significantly quicker transaction speeds than its nearest rivals, Ethereum and Cardano (ADA), at a fraction of the cost by utilizing a special mix of proof of history and delegated proof of stake.

Proof of history employs timestamps in its definition of blocks for the Solana chain as opposed to proof of work, which uses the miners themselves to determine the next block in a chain, or proof of stake, which uses staked tokens to determine the next block.

This cutting-edge technology enables blockchain validators to vote on the timestamps of various blocks in the chain. This maintains the chain’s decentralization while also enabling quicker, more secure calculations.

How Does Solana Work?

Solana uses protocols for both delegated proof-of-stake and proof-of-history transactions.

According to Bryan Routledge, an associate professor of finance at the Tepper School of Business at Carnegie Mellon University, Solana is using this mix of protocols to “handle lots of transactions fast.”

Routledge notes that centralization is typically necessary when attempting to handle transactions fast. For instance, Visa requires a sizable computer network to maintain its processing speed. In contrast, Routledge claims that Bitcoin “processes transactions very slowly” in order to maintain its decentralized nature.

Solana tries to process transactions at speeds equivalent to a big, centralized firm like Visa while keeping the decentralization of Bitcoin because the whole goal of blockchain technology is to enable decentralized services. Since Solana’s technologies have reduced financial and environmental costs, this speed enables greater scalability.

Solana’s blockchain needs higher degrees of security because to how quickly blocks are added to it. Solana’s proof of history algorithm is useful in this situation. This technique timestamps every block in a way that preserves the security of the system.

The SOL tokens of Solana are then staked and utilized as security for network transactions. These transactions range from utilizing Solana as a non-fungible token (NFT) marketplace to verifying smart contracts.

Degenerate Ape Academy’s debut as the first significant NFT project on the Solana NFT marketplace in August 2021, more than a year after Solana’s inception, was one of the platform’s great breakthroughs. Solana’s price increased from from $30 to $75 in the first three weeks of that month.

The top value of Solana occurred in November 2021, at the height of the cryptocurrency bull run, when it reached around $260.

Solana vs. Ethereum

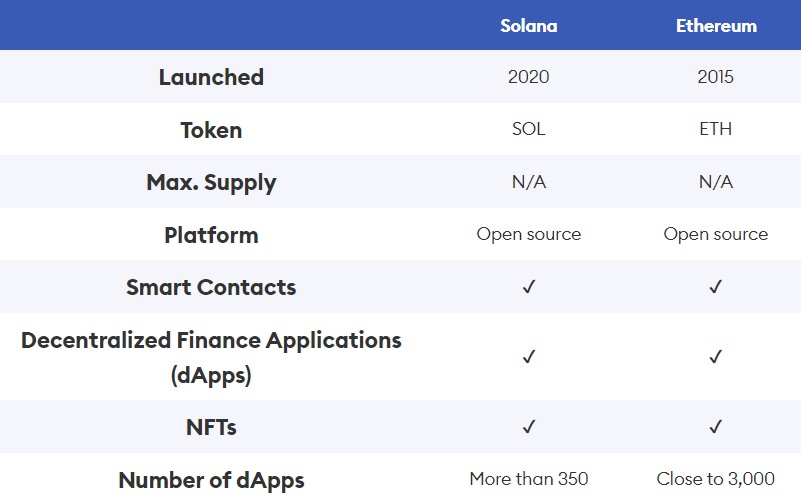

While Solana and Ethereum share certain similarities, they also have significant distinctions. Here is a brief summary of the areas where the two platforms divide and overlap:

Additionally, Solana Labs, the technology business owned by Solana, is developing a number of intriguing things, as Hazim points out. One of these is Solana Pay, which enables less expensive, safer, and quicker transactions.

The Solana Mobile Stack has also been released by Solana Labs. The potential for mobile expansion is made possible by this Android toolkit. Early 2023 is when Solana anticipates releasing their smartphone, the Solana Saga.

Investing in Solana

SOL tokens may be traded on a variety of exchanges, much like the majority of the main cryptocurrencies in the world. Centralized exchanges like Binance.US, Coinbase, and Kraken, to mention a few, fall under this category. SOL tokens are even accessible in crypto and NFT ATMs in various global locations.

Investors will wish to keep their SOL tokens after buying them in a cryptocurrency wallet. Contrary to what the name suggests, cryptocurrencies are not kept in crypto wallets. Instead, they serve as the owners’ main storage locations for bitcoins. It is possible to keep these wallets offline or online. (Offline cold wallet storage is the safest choice.)

There are several applications for SOL tokens. They may be utilized, among other things, for peer-to-peer payments, trade, and as a motivator to protect the Solana network as a validator.

But before buying Solana, investors, as with all cryptocurrencies, should think about talking to a financial counselor.

Cryptocurrencies are incredibly hazardous and volatile financial instruments. Even if they are confident in Solana’s potential, investors should be assured they can afford to lose the money they invest in SOL.