Without a doubt, Ethereum is the most popular platform for smart contracts now in use. The platform has developed steadily since its launch in July 2015, with a notable rise in the number of decentralized applications (DApps) it hosts.

On the Ethereum network, approximately 3,000 DApps and over 5 million smart contracts are already active. A large portion of them work in the quickly growing decentralized finance (DeFi) sector, which at its peak attracted more than $160 billion in total value locked (TVL), a metric for the value of assets held by DeFi smart contracts.

However, the Ethereum network is under load due to the 1.7 million daily transactions and about 800,000 active addresses. This may result in enormous traffic, astronomical expenditures, and a poor user and developer experience overall.

Several technology advancements are planned for integration to help address this danger and strengthen the Ethereum blockchain’s ability to face the future. For instance, Ethereum will prepare for future performance improvements by switching to a more energy-efficient consensus mechanism during the impending “merge.”

What exactly is the Merge?

The Ethereum network can now handle 10 to 15 transactions per second (tps). The amount of transactions in the block and the average block time are two elements that affect this.

As a result, it is among the slowest smart contract systems now in use. Second- and third-generation platforms like Solana, Avalanche, and BNB Chain have recently outperformed it. along with a few less well-known platforms.

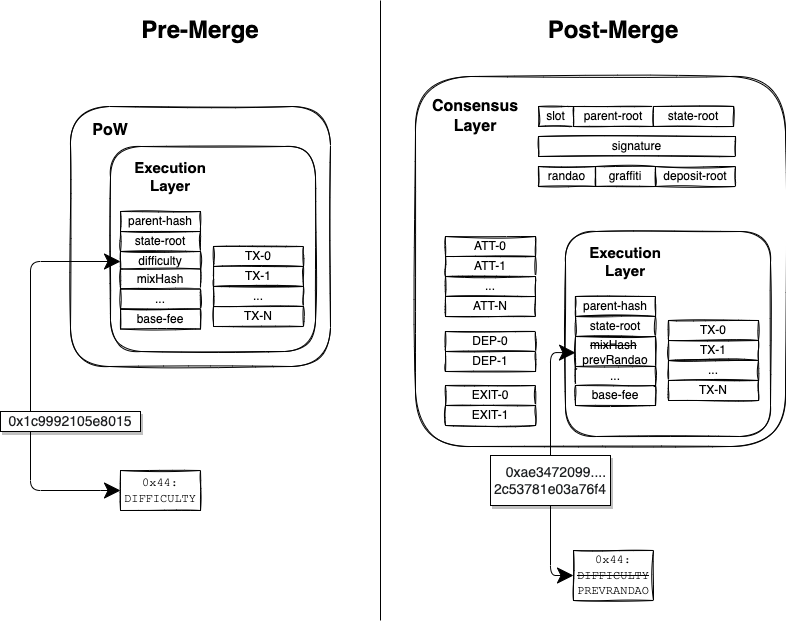

Fortunately, Ethereum can be improved, and the biggest enhancement is now in development. The current Ethereum execution layer and the beacon chain, a previously separate consensus layer, will be integrated to create a new hybrid platform, which is known as “the merging.” Instead of tens of thousands of miners, this new hybrid platform will be supported by a network of hundreds of thousands of validators.

The launch of the Ethereum beacon chain was on December 1, 2020. The goal of the beacon chain (formerly known as Eth2) is to serve as a testnet for the new Proof-of-Stake system, demonstrating the stability and viability of Proof-of-Stake for a big, well-established smart contract platform like Ethereum. It is in responsible of managing validator data, assigning blocks, and both rewarding validators with inflation incentives and punishing bad actors by cutting.

The beacon chain now lives totally independently of the original Ethereum chain (known as the execution layer). The beacon chain is now being stress tested, and its validators are working hard to process testnet transactions and keep order.

Most Ethereum testnets have either switched to Proof-of-Stake or are in the process of doing so in the next months. The most recent was the Ropsten testnet merger in June 2022, with the remaining two testnets — Goerli and Seoplia — slated to combine in Q3 2022.

Ethereum developers have set a possible completion date of September 19, 2022. It should be emphasized, however, that the merger has been postponed multiple times in the past, so nothing is written in stone.

How Will Ethereum Change Following ‘The Merge’?

Although the transition to Proof-of-Stake is the most significant development in Ethereum’s history, it is not the only thing that will change following the merger.

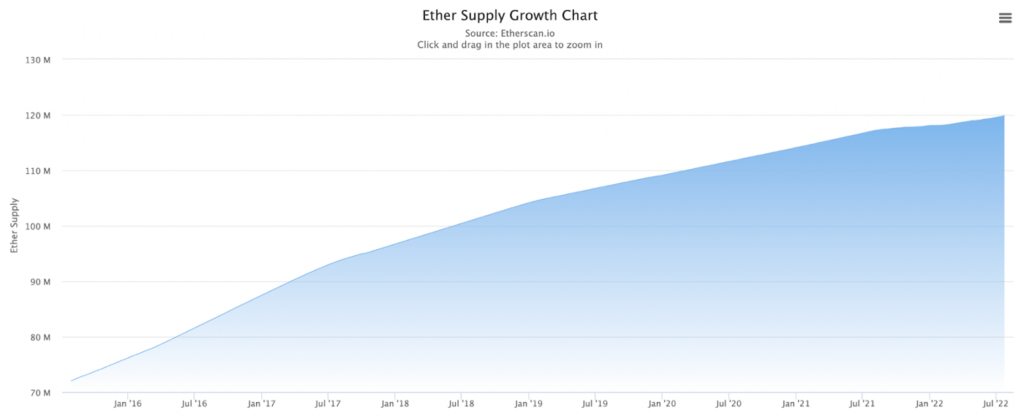

Ethereum’s inflation rate will also be dramatically reduced. Currently, Ethereum inflates at a rate of roughly 4.3% to just 0.43% – a 90% drop. This inflation will be spread among validators based on the amount of blocks processed, with each validator having an equal chance of being chosen to produce blocks.

Following the merging, validators will get just 1,280 ETH each day as block rewards. Fees are likely to account for a growing portion of validator revenue as the network expands.

Since the recent introduction of EIP-1559, a portion of every transaction fees has been incinerated. Since a result, some feel that Ethereum may become a deflationary asset, as the fees generated by EIP-1559 may surpass the incentives granted to validators. This happened for the first time lately and is expected to become more often in the future.

Additionally, the average block time will decrease from over 13 seconds to 12 seconds, or the amount of time it takes to process each new block. As a consequence, transactions will be included in blocks 8% quicker.

The merger will pave the way for a series of subsequent improvements, each of which will extend the platform’s capabilities. The idea to split the blockchain into 64 distinct shards, each of which will be able to process blocks in parallel, is by far the most crucial of these. This will significantly increase Ethereum’s throughput and enable it to perform thousands of transactions per second.

Additionally, the average block time will decrease from over 13 seconds to 12 seconds, or the amount of time it takes to process each new block. As a consequence, transactions will be included in blocks 8% quicker.

The merger will pave the way for a series of subsequent improvements, each of which will extend the platform’s capabilities. The idea to split the blockchain into 64 distinct shards, each of which will be able to process blocks in parallel, is by far the most crucial of these. This will significantly increase Ethereum’s throughput and enable it to perform thousands of transactions per second.

After sharding is implemented, virtually everyone will be able to operate an Ethereum client, contributing to increased security and network decentralization.

More importantly, it will reduce transaction fees. Gas costs will certainly decline as competition for block space decreases, making the platform significantly more cost-effective to utilize. As a result, Ethereum will become increasingly appealing to people, corporations, institutions, and even governments, making it the platform of choice for decentralized applications.

In terms of energy efficiency, scalability, security, and environmental friendliness, these enhancements are likely to help Ethereum outperform rival smart contract systems. It may also result in the deprecation of a number of layer 2 platforms that seek to enhance Ethereum’s capabilities through the usage of sidechains. Because these primarily attempt to increase scalability and lower expenses, systems such as Optimism, Arbitrum, Immutable-X, and others may become obsolete.

Users must stake at least 32 ETH to act as a validator and help with the block production process. This ETH will be held until the Shanghai upgrade is finished. This will happen 6-12 months following the merging, at which point users will be able to withdraw their staked ETH.

Regular users will be able to continue communicating with Ethereum using their favorite Web3 wallets, and interfacing with DApps will stay nearly unchanged. Users who now operate a node must run a separate client for both the execution layer and the consensus layer. Here is a list of some of the most popular clientele.

In the future, Ethereum will include ZK-SNARKS into its stack, enabling totally private transactions and smart contract operations. This will be paired with the protocol-level introduction of rollups, allowing Ethereum to expand further by performing transactions off-chain before confirming them with an on-chain rollup. These two prospective changes are presently under investigation, with no set timeframe for implementation.

Why the Transition to Proof of Stake?

A massive network of power-hungry SHA-256 miners fight to find the next block, fill it with transactions, add it to the blockchain, and then broadcast the modified state to the rest of the network. This is how Ethereum’s Proof-of-Work (POW) consensus method protects the cryptocurrency now.

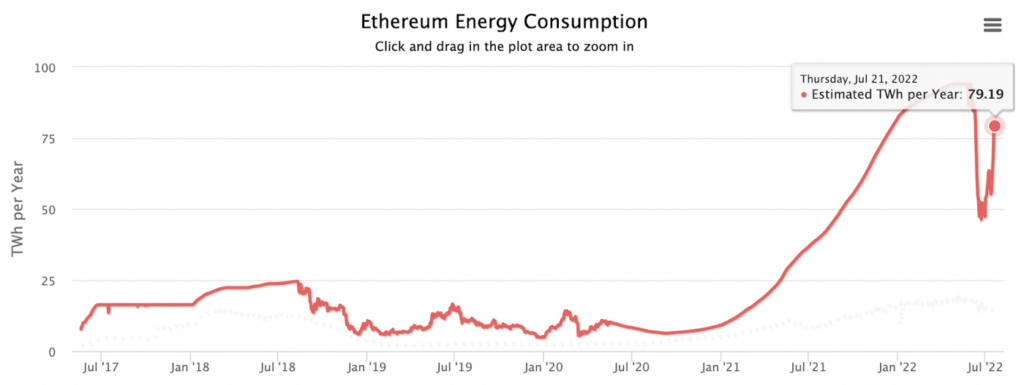

According to Digiconomist’s most current calculations, this mining network consumes around 79 terawatt-hours of power every year. This is slightly higher than Austria’s total energy usage (66.8 TWh/yr) and results in the annual emission of about 34 million metric tons of CO2 into the environment.

This, predictably, has resulted in a significant amount of criticism directed against Ethereum (and other POW cryptocurrencies), with detractors claiming that its environmental impact is unjustifiable.

With the imminent merging, Ethereum will reduce its energy load by more than 99.95% by transitioning to Proof-of-Stake. This will not only make it one of the most energy-efficient smart contract systems in operation, but it will also lower its present energy load to a sliver of what it is. In fact, a POS-based Ethereum would emit nearly the same amount of CO2 as 3,681 gas-powered passenger automobiles.

The new improvement is intended to help transform the reputation of Ethereum and other blockchain technologies, since environmental issues have received substantial legislative resistance and are a major bone of dispute among potential users, investors, builders, and institutions.

According to Statistica statistics, this will reduce the average energy usage of a single Ethereum transaction to roughly 0.1 KWh – still 80 times greater than the Visa payment system. However, because Ethereum is anticipated to receive a considerable performance boost when it is split into 64 sharded chains, the energy cost per transaction will be about comparable to Visa.

According to Ethereum Co-Founder Vitalik Buterin’s 2020 thinking paper, Proof-of-Stake will help Ethereum to maintain its industry-leading security by ensuring that the cost of attack remains constant. However, the “slashing” technique, which would be used to penalize validators who participate in assaults without needing a network re-org or fork, lets the network to recover faster from attacks.

“Attacking the chain for the first time will cost the attacker millions of dollars, and the community will be back up and running within days.” Attacking the chain a second time will still cost the attacker millions of dollars since new coins must be purchased to replace the old ones that were burnt. And the third time will… cost even more millions. The game is very asymmetric, and the odds are stacked against the attacker.” — Vitalik Buterin

The merge is a critical next stage in Ethereum’s progress, perhaps demonstrating its potential uses in dozens of new industries. Nonetheless, only time will tell if it lives up to expectations, and we have yet to see how the competition will react to an enhanced Ethereum’s potential technological dominance.