Crypto arbitrage is a method of investing which has helped many investors make phenomenal profits with the help of this method, though it requires human attention. Automate it, and it will make arbitrage much easier.

In this article we will go through how it works , the different ways of arbitrage, and the pros and cons, so shoo your worries away. You’re in the right place.

The Crypto Arbitrage

An investor simultaneously buys and sells an item to profit from price discrepancies in other markets, but with the help of an automated trading system (A.I.). When it starts working, it becomes sort of an exploit due to how effective and efficient it is when it starts working. It comes at a high price, though. It requires top-tier skills and experience in programming and takes quite a long time to make, even in the hands of a professional. It’s kind of worth it, though.

The profit from the price differential is also influenced by the number of sales. On a small scale, it might not be significant, but on a large scale, arbitrage’s potential profit is significantly margined. For investors who can detect and act on opportunities, arbitrage is a low-risk but high-gain strategy.

Arbitrage is largely a byproduct of market inefficiency when data and liquidity are dispersed across all markets rather than integrated. Arbitrage continues to be a major problem for market makers at the moment. In other words, the growth of arbitrage profit is inevitable and is being driven by the emergence of Decentralized Finance (DeFi) in the cryptocurrency market.

How does it work?

The objective of arbitrage trading for traders is to generate profits by purchasing an asset at a certain price and then selling it at a higher price. Here is a straightforward illustration of how a successful arbitrage works:

A trader notices a difference in the price of Bitcoin between two markets (crypto exchanges).

- In market A, Bob purchases 1 Bitcoin for $50,000.

- Bob moves his single Bitcoin to the B market, the alternative market.

- Bob sells 1 BTC at $55,000 and makes a $5,000 profit because of the $5,000 price difference.

- Be aware that the profit will be less than $5,000 if expenses are added.

In addition to generating profits for traders, arbitrage increases market liquidity and reduces some market inefficiencies. By reducing the price differences of similar assets, it fills the gap between various exchanges.

An obviously the primary requirement for a successful arbitrage is the price difference. Arbitrage could result in a loss if traders make incorrect calculations. The aforementioned arbitrage example is the most basic. Traders will occasionally convert assets more than once before making a profit in order to carry out more complicated transactions.

The Different Forms of Crypto Arbitrage

Exchange

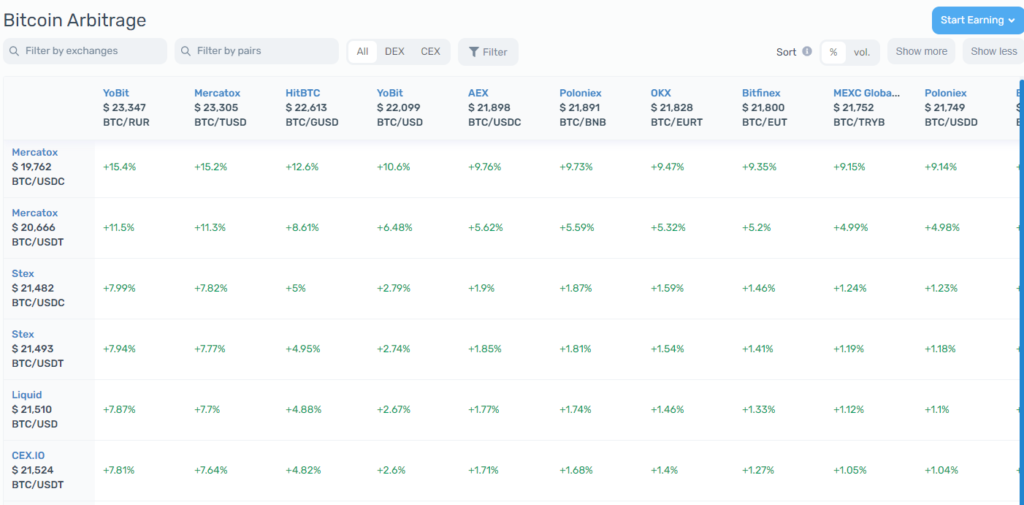

While some markets have a partnership and share liquidity, other markets have separate, independent liquidity. Due to this, market inefficiencies are created, which presents arbitrage opportunities.

It is also the most fundamental form of arbitrage, which is exchange-based arbitrage. To profit, traders only need to buy the assets on one exchange and sell them on another. Traders make more money when the spread is wider.

Funding Rate

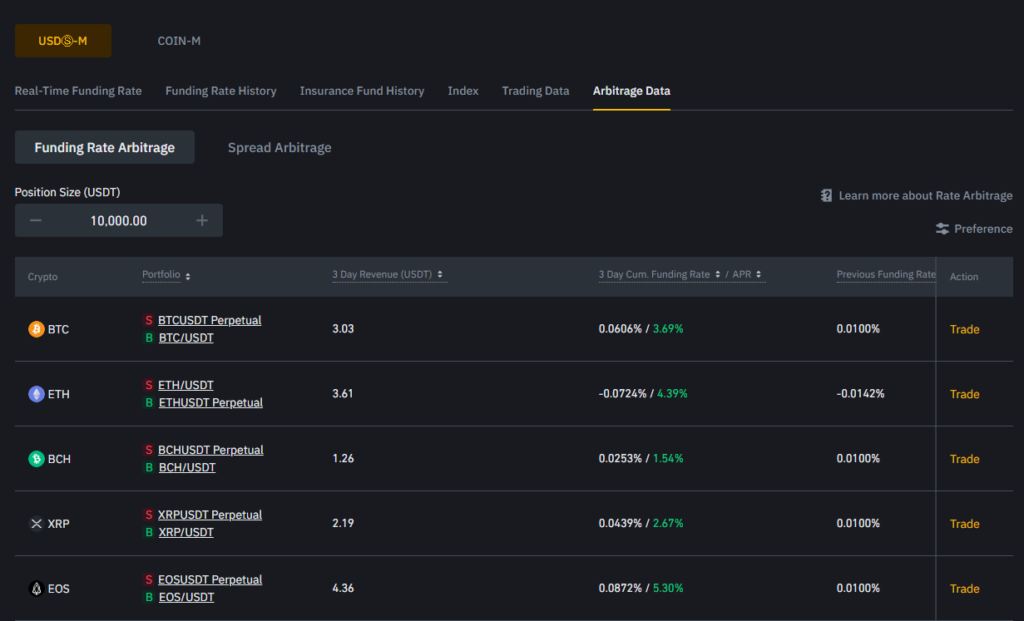

The difference between the prices of perpetual contracts and the underlying assets is filled in by the funding rate, which is expressed as a percentage. Perpetual traders must pay fees to others on a periodic basis, regardless of whether they are opening long or short positions.

The funding rate and position size are key factors in funding rate arbitrage profit. Therefore, in order to avoid making any unprofitable investments, we should consider many of the aforementioned factors.

Long-positioning traders will eventually be required to pay funding fees to short-positioning traders if the funding rate is positive (in an uptrend). So, how can we use the funding rate to engage in arbitrage?

Using the funding rate arbitrage strategy, investors can profit from the funding charges they pay when they open any long or short positions. Investors open a counter position with the same volume to offset the loss resulting from price movement of perpetual positions.

Investors could, for instance, open a short position worth $10,000 and then purchase $10,000 worth of the same cryptocurrency on the spot market. In the event that the funding rate is positive, investors profit from funding fees rather than suffer losses from price changes.

FAQ

Is it Legal though?

Yes it is legal, since market inefficiencies lead to the emergence of arbitrage. Arbitrage is encouraged by the profits, which makes markets more effective.

Is using Arbitrage Bots actually worth it?

Time-sensitive automation tasks are a good fit for bots. They are able to complete trades in a matter of seconds or even microseconds, generating a series of small profits that add up to a sizable profit. In addition to automating, price difference detection software can be programmed into bots. Because of this, users of detection bots are able to identify exceptional chances for massive financial gain.

But investors cannot be assured of making money using arbitrage bots. Before purchasing or creating arbitrage bots, it is best to give the matter careful thought.

Is Arbitrage Profitable?

Due to the small price differences, arbitrage profits are frequently low. Price differences of about 10% are extremely uncommon, typically occurring in increments of just a few percent. However, because each arbitrage is quick to execute and traders can execute many of them each day, the profits add up over time.

Conclusion

Arbitrage, it maybe profitable but it requires a high amount of skill and experience in order to succeed with performing such task. Which is also why some considered getting themselves an automation bot to make things easier for them and since bots are more skilled at identifying potential arbitrage. Traders are currently competing to take advantage of arbitrage opportunities.

We hope that this article has helped you learn more about the world of crypto and to decide whether to do some arbitrages or no, and to get an automation bot for it or no.

That’s it for now folks! See you in the next post, peace!