The chief executive of the spot cryptocurrency exchange EDX Markets, Jamil Nazarali, said that the venue’s distinct quotations for retail and institutional investors will set it apart since they allow for tighter pricing and better execution.

Nazarali, who earlier served as Citadel Securities’ global head of business development, told Markets Media that his years of expertise in traditional finance and introducing fresh ideas are quite useful.

The first items that will be traded on EDX are Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. EDX Markets announced the opening of its digital asset exchange and the conclusion of a financing round with additional equity partners in June of this year.

According to Nazarali, one advantage for EDX is that it will offer distinct quotations for retail and institutional investors, as well as increase transparency by offering the complete depth of book.

Due to the engagement of several market makers, “our retail-only will benefit participants by providing tighter prices,” he noted.

DV Crypto, GTS, GSR Markets LTD, and HRT Technology, together with Miami International Holdings and other market makers, recently finalized a fresh investment round with the firm. They join the initial investors, which also include well-known financial institutions including Virtu Financial, Charles Schwab, Citadel Securities, Fidelity Digital Assets, Paradigm, and Sequoia Capital.

The blockchain will be used to net and settle trades, doing away with the need for pricey bilateral settlement and allowing for increased speed and efficiency. Assets will be held in a network of independent digital custodians, just like conventional finance.

To run a spot cryptocurrency exchange, EDX does not require regulatory clearance; however, the company also has intentions to open a clearinghouse, which will require such approval. Trades matched on EDX Markets will be settled by EDX Clearing, allowing players to profit from increased pricing competition and less settlement risk. According to Nazarali, the use of a single settlement method by EDX Clearing will increase competitiveness and boost operational efficiency.

Technology will be provided to EDXM by MEMX, which runs a US equity exchange and plans to start a US options exchange. Nazarali clarified that Citadel Securities had invested in MEMX and that he also served as the organization’s board of directors. And he said, “I knew the quality of the technology and team at MEMX, which was important to us.”

In a statement, MEMX CEO Jonathan Kellner said: “This marks a new chapter for MEMX as we bring our scalable market technology to other asset classes and market operators.”

According to Nazarali, there has been a significant response to the announcement from June, which reflects latent demand for safe and legal trade of digital assets through reliable intermediaries. EDX Markets is presently concentrating on onboarding institutions, and Nazarali stated that he would like EDX to be recognized in 12 months as a reliable middleman in the cryptocurrency markets for the execution of client flow.

“The roadmap for expansion includes trading more tokens, launching derivatives, and international expansion,” claimed Nazarali.

ETFs for Bitcoin

The debut of EDX coincides with traditional asset managers filing for spot bitcoin ETFs, which the US Securities and Exchange Commission earlier rejected clearance for, despite the SEC having authorized ETFs on listed bitcoin futures.

Since the BlackRock bitcoin ETF filing in June, the price of bitcoin has changed significantly.

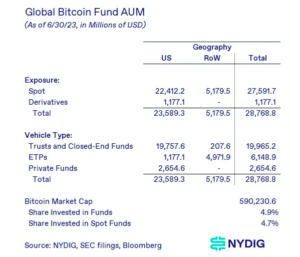

Although a spot bitcoin ETF has never been available in the US, Greg Cipolaro, global head of research at bitcoin company NYDIG, stated in a report that significant investment has already been made in existing structures like the Grayscale Bitcoin Trust (GBTC), futures-based ETFs in the US, spot-based ETFs outside of the US, and private funds.

According to Cipolaro’s study, these products account for $28.8 billion in assets under management, $27.6 billion of which are invested in spot products.

However, Cipolaro went on to say that a spot ETF could have advantages such as better liquidity, lower tracking error and costs, familiarity with purchase and sale methods through securities brokers, simplicity of position reporting, risk measurement, and tax reporting, as well as the reputation of BlackRock and the iShares franchise.

Since the initial registration statement for a spot bitcoin ETF was filed more than ten years ago, investors are once more thrilled about the likelihood that one of the current applications would be accepted, according to Cipolaro. We advise participants to assess their choices according to the likelihood that they will ultimately be approved because a slot ETF is still not assured. The future’s path is probably anything from simple, if the procedure for previous bitcoin ETFs is any indication.

Five applications for bitcoin ETFs from BlackRock, Fidelity, Invesco Galaxy, VanEck, and WisdomTree were published in the Federal Register on July 19, 2023, establishing a deadline for the SEC to examine the proposals.

To list and trade shares of the iShares Bitcoin Trust, for instance, Nasdaq submitted a proposal.

“After issuing the Bitcoin Futures Approvals,” the filing continued, “which conclude that the CME Bitcoin Futures market is a regulated market of significant size as it relates to Bitcoin Futures, the only consistent outcome would be approving Spot Bitcoin ETPs on the basis that the Bitcoin Futures market is also a regulated market of significant size as relates to the bitcoin spot market.”

Additionally, Nasdaq is recommending that additional actions be taken to strengthen its capacity to gather data that would be beneficial in identifying, looking into, and preventing fraud and market manipulation in the Commodity-Based Trust Shares. The exchange and Coinbase, a publicly traded cryptocurrency exchange, agreed to the parameters of a surveillance-sharing agreement on June 8, 2023.

It’s anticipated that the deal would be a bilateral surveillance-sharing pact between Nasdaq and Coinbase, which aims to enhance the Exchange’s market monitoring program.

The Spot BTC SSA, which would grant the Exchange additional access to information regarding spot Bitcoin trades on Coinbase when the Exchange determines it is necessary as part of its surveillance program for the Commodity-Based Trust Shares, is anticipated to have the characteristics of a surveillance-sharing agreement between two members of the ISG. To monitor the trading of Commodity-Based Trust Shares, the Exchange will use market data for orders and transactions that it anticipates receiving from Coinbase.

If the exchange decides that further information on spot bitcoin trading activity is required to identify and look into any manipulation in the trading of the Commodity-Based Trust Shares, it may also seek more information from Coinbase.