Delivering a decentralized web3 blockchain and placing its native DOT token among the top five digital assets by market capitalization, Polkadot has completely taken over the cryptocurrency industry.

The innovative architecture of Polkadot offers a remedy for the scalability problems that have plagued previous blockchains, causing crowded networks and excessive transaction costs.

Polkadot (DOT) has caught your attention, but you’re not sure what it is or where to start. Not to worry. This manual is intended to provide you with all the information you want on the project and to prepare you for the easiest trading environment currently accessible.

What is Polka Dot (DOT)?

A compatible and purpose-built blockchain may be created using Substrate, a framework that enables the production of bespoke or pre-built blockchains, to create Polkadot, a scalable, secure, and decentralized multi-chain network for the next web.

Polkadot offers an interoperability protocol that employs segments, or shards, to extend the network in order to create a truly decentralized web where users are in charge. It can link independent blockchains, public networks, and oracles to enable a new type of web where information and transactions can be exchanged without any intermediaries.

The Polkadot network’s native token currency is called DOT, and its tiniest unit is referred to as a Planck. Tokens are locked up as part of linking new chains to the Polkadot network or playing another function in the ecosystem. It supports payments, network governance, staking, reward incentives, transaction fees, and other bonding procedures.

DOT’s supply is unrestricted, unlike the majority of other cryptocurrencies. This is intended to stimulate the network and dynamically change in accordance with user staking participation rates, increasing by up to 10% annually.

Polkadot: How Does It Operate?

Polkadot uses a method of public and private key encryption to enable the transfer of money from one digital wallet to another. Your recipient address is the hash of your public key, and your private key serves as a password for approving and broadcasting transactions over the network. These pending transactions are confirmed in a block of transactions every six seconds or so, and the blocks collectively make up the Polkadot blockchain.

Of course, Polkadot provides much more than just the ability to send and receive money. Polkadot is a sharded multi-chain network that may process data and transactions on many chains simultaneously, or “parachains,” under the control of a central relay chain. Due to its sharded architecture, the network is divided into several sections, or shards. Because transactions may now be handled concurrently on each shard rather than sequentially over the whole network as they were in earlier blockchain generations, throughput has increased.

Therefore, many Parachains may connect to Polkadot, benefiting from the network’s overall security while greatly enhancing scalability, interoperability, and cross-chain capability and removing the congestion, excessive fees, and incompatibility of older blockchains. With the aid of a governance structure run by owners of the DOT native token, Polkadot maintains improvements automatically without the need for hard forks.

Instead of the mining reward incentives given in Proof-of-Work blockchains like Bitcoin, Polkadot employs a Nominated Proof-of-Stake (NPoS) consensus mechanism, paying users for locking up DOT tokens in a process known as staking.

Holders of DOT tokens can stake tokens to participate as Nominators, choosing to support up to 16 Validators as trusted candidates with their stake. Collators on Polkadot maintain Parachain nodes, Fishermen nodes keep the network safe, and Stakers interested in maintaining the entire network can run a Validator node. Then, validators create new blocks, check Parachain blocks, and ensure finality. Later on, we’ll go into further depth about these duties.

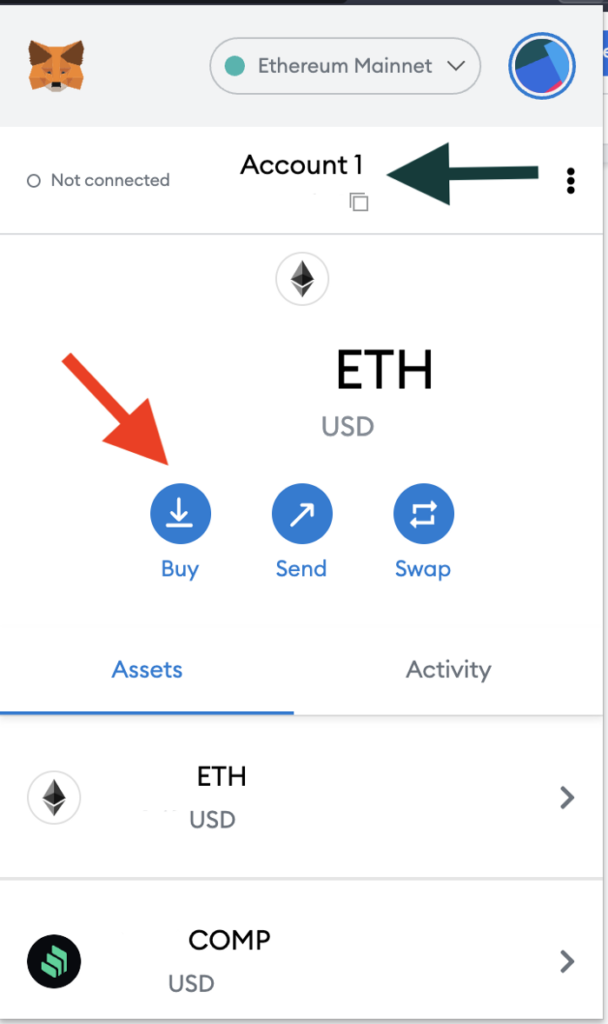

There are two very significant details about a polka-dot wallet that you must be aware of:

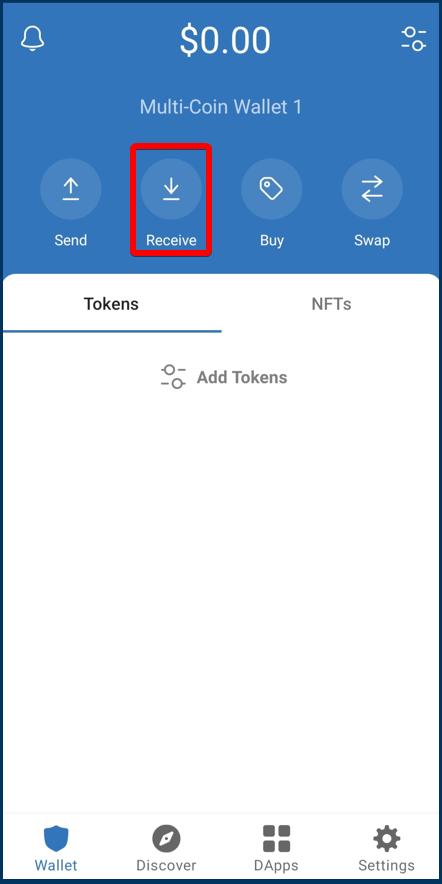

A string of numbers and letters used to transfer funds to the Polkadot wallet. Through the wallet address you specify, others can send money to you. The format of a Polkadot (DOT) wallet address is 16FuasKqTX5WLaLsWCnrXC4i3KWm717k2bBHJgK3fw4ZY5qn.

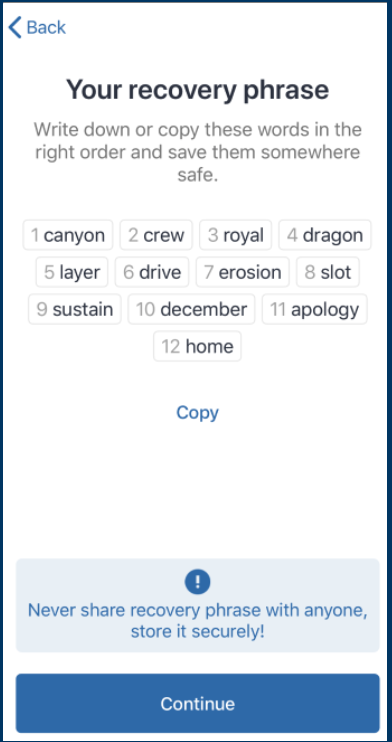

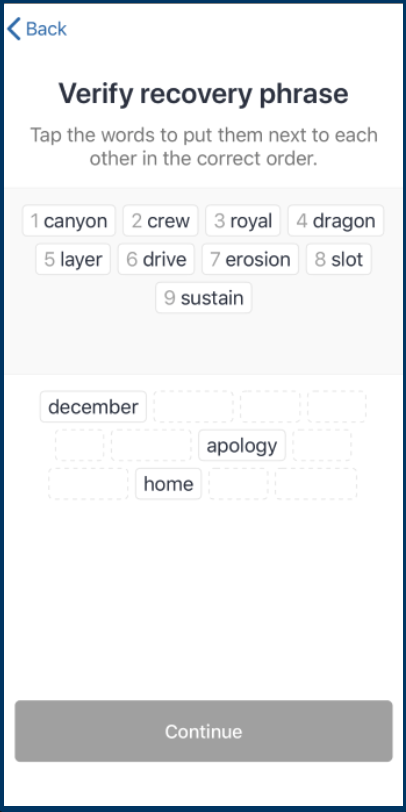

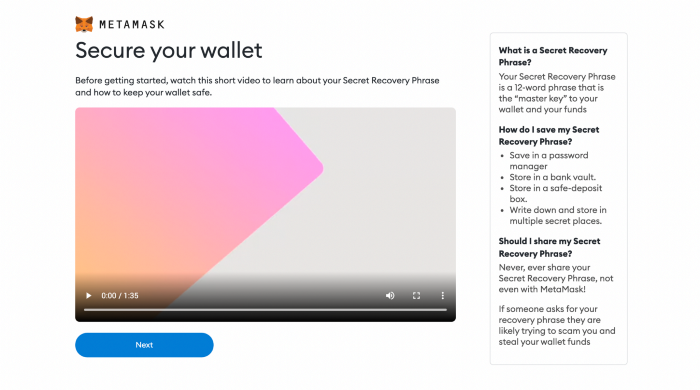

An encryption key that may be used as a password and contains any 12 English words. You must complete the Passphrase login stage if you want to carry out the wallet recovery process. Password format: full yearly slow album wisdom snow slice refuse pony flower middle beneath.

Consider the Polkadot wallet as a bank account, with the address on the wallet serving as the account number and the passphrase serving as the password.

With a bank account, however, other individuals will be aware of your personal information. Regarding the Polkadot wallet, transactions only take place through the address, which is encoded into a string of numbers and characters, and the user becomes anonymous; nobody knows who owns the wallet.

What Sets Polkadot Apart?

Among the top blockchain systems, Polkadot is exceptional in that it offers sharding for scaling, the pooled security of a central relay chain and adaptive consensus, as well as the interoperability of a multi-chain network. Throughput is substantially increased by the parallel processing made possible by performing transactions in different shards, and cross-chain capabilities allows transfers of any kind of data or asset across shards.

Polkadot also reduces the need for projects to select between several separate blockchain networks by offering interoperability with already-existing platforms like Ethereum, with clearly defined community governance, and automated updates.

Due to Polkadot’s use of the Substrate blockchain technology, other projects utilizing Substrate may rapidly and easily develop bespoke chains that operate natively on Polkadot. This implies that you may use the framework to begin developing a blockchain before you are ready to release it to the network.

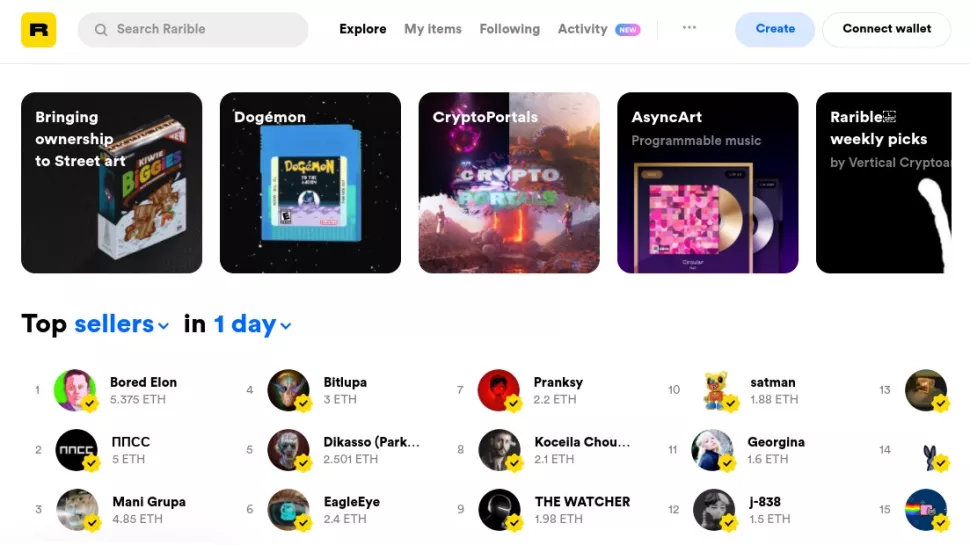

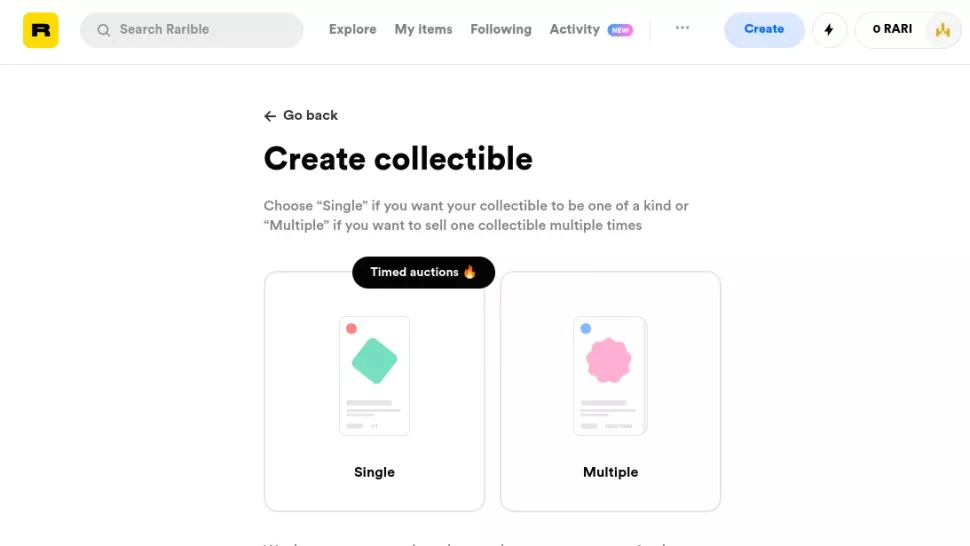

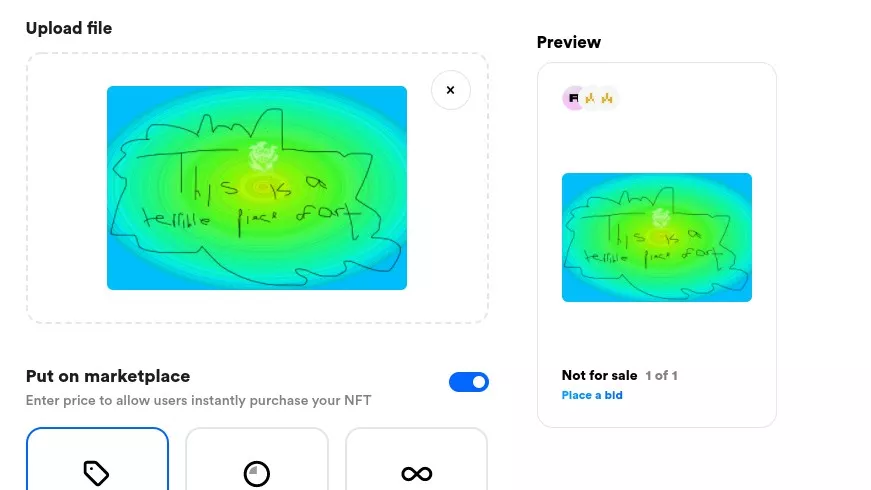

The promise of Polkadot really resides in enhancing current blockchains rather than competing with them, despite the “Ethereum killer” moniker that it occasionally receives. Over 350 projects in its ecosystem that are developing smart contracts, decentralized finance (defi), oracles, digital collectibles (NFTs), gaming, and other solutions, most notably Chainlink and 0x Protocol, have already acknowledged this.

Polkadot is not a platform for smart contracts by itself. As a result, major protocols have seen the highest rise in active developers. Instead, it provides the framework for decentralized app (dApp) developers to incorporate smart contracts across an interoperable network with wide-ranging functionality.

What Adds Value to Polka Dots?

With over $20 billion in staked value, Polkadot is presently one of the top staking platforms, delivering projected payouts of over 13% annually. The market capitalization is approximately $30 billion, and more than half of the qualifying tokens are held.

By staking DOT, customers may, in addition to any financial gains, counteract the rate of inflation compared to simply holding and get an annual return on their investment. In proportion to the amount of DOT they are staking, DOT also gives participants the option to vote on network enhancements and future feature sets.

Many projects have already been attracted to Polkadot because of its scalability, interoperability, and cross-chain functionality, including Acala’s cross-chain defi hub and stablecoin platform, Moonbeam’s smart contract Parachain that enables developers to use existing Ethereum dApps on Polkadot, Chainlink’s oracle technology, and Polkastarter’s decentralized exchange platform. As a result, the network and the DOT tokens needed to create, secure, or use Polkadot Parachains gain value and utility over time.

How Secure Is the Polkadot Network?

In order to optimize chain security, Polkadot’s consensus process, NPoS (Nominated Proof-of-Stake), was created with the responsibilities of Validators, Collators, Fishermen, and Nominators.

By staking DOT to operate validating nodes and carry out a thorough examination of the Relay Chain, validators protect the network. Additionally, they verify Parachains and engage in consensus with other Validators to determine the real shared state of the network, rejecting any fraudulent transactions in the process. In exchange for getting incentives, they contribute new blocks to the Relay Chain, which indirectly benefits all Parachains by participating in its security.

Regardless of stake, the Polkadot network distributes validation incentives to all Validators equally. In order to encourage a more evenly-staked collection of Validators, staking benefits are then given pro-rata to all stakers following the deduction of the Validator payment.

For the Relay Chain and their specific Parachain, collators save a full node history. Collators combine Parachain transactions to create fresh Parachain block candidates that Validators may verify in the Polkadot network’s shared state. After a block candidate has been approved by the Relay Chain Validators, a Collator cannot proceed with adding blocks to a Parachain.

Additionally essential to XCMP cross-chain transmission are collators. They are all aware of one another as peers since they are all complete nodes of the relay chain. They can use this to communicate from Parachain A to Parachain B.

Fishermen and Collators are both complete nodes of Parachains, but they take on separate policing responsibilities. Fishermen watch for incorrect transactions in the Collator process and report them to Validators. If a report turns out to be accurate, they are paid; however, if they are incorrect, they run the danger of losing their needed role stake in the relay chain.

And at last, Nominators are active DOT token owners who contribute to protect the Relay Chain by staking DOT and choosing qualified Validators in exchange for a portion of the staking benefits but do not wish to bear the expense and burden of other positions in the network. This encourages greater network security involvement and cautious Validator selection because if Validators act inappropriately (such as going offline, attacking the network, or running changed software), both Validators and Nominators will lose a portion of their staked DOT.

How Can Polka Dot Be Used?

For many organizations and people, Polkadot provides a variety of uses. It makes it possible to use a different, decentralized payment mechanism free from the meddling of middlemen, giving you more control over your money.

As an alternative to costly and drawn-out foreign transfers, DOT may also be used for speculation and investing. For the hundreds of millions of individuals who have access to cellphones but no bank accounts, it can also help create an alternative financial system. We are also presenting a new potential for income production or augmentation through DOT staking.

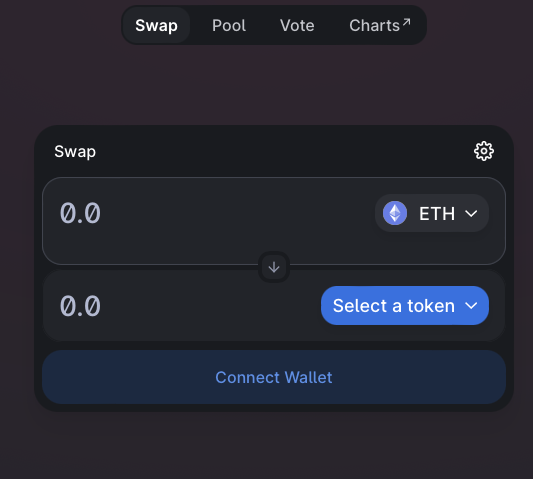

The use cases for projects working on defi, oracles, digital collectibles, gaming, IoT, privacy, gaming, cross-chain solutions, and more are expanded by Polkadot’s interoperable, scalable, secure, and decentralized platform, which eliminates the bottlenecks and high transaction fees of legacy blockchains.

How Should I Pick My Polka Dot Wallet?

Your choice of DOT wallet will probably be influenced by the purpose for which you’ll use it and the quantity of items you need to keep.

The most secure solution comes from hardware wallets, also known as cold wallets, which offer offline backup and storage. DOT currently only supports Ledger hardware wallets in combination with the official Polkadot-JS online wallet. However, hardware wallets come at a higher cost and with a little bit more of a learning curve. As a result, they could be more suited to holding more DOT for more seasoned users.

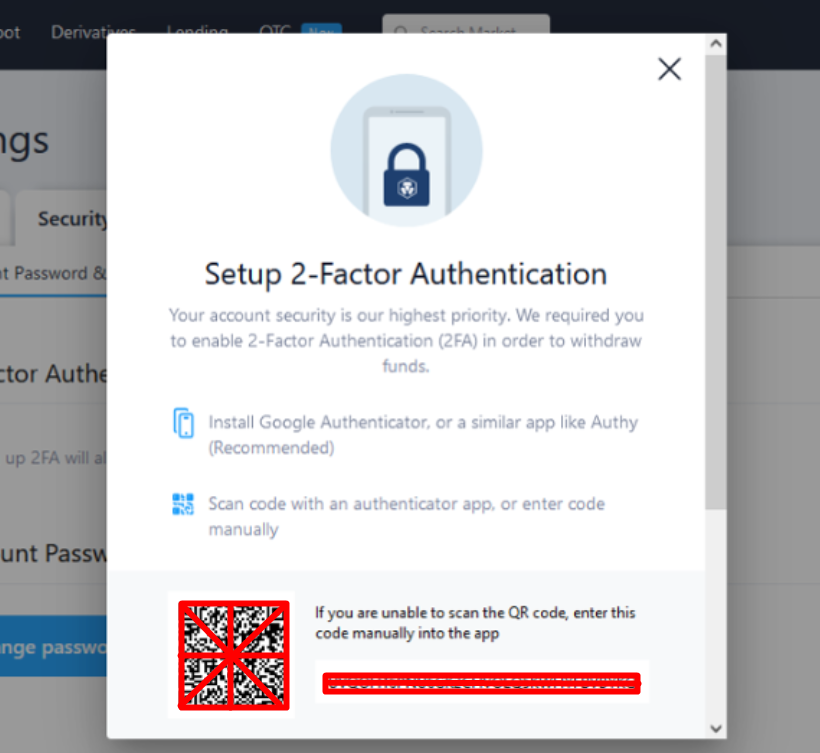

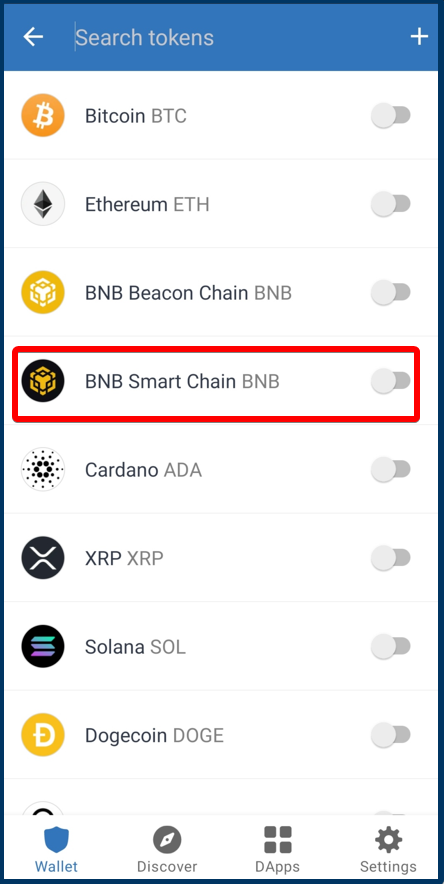

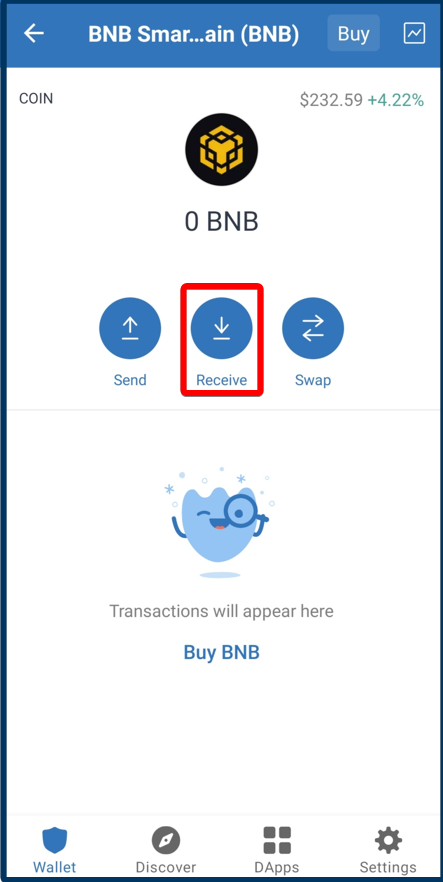

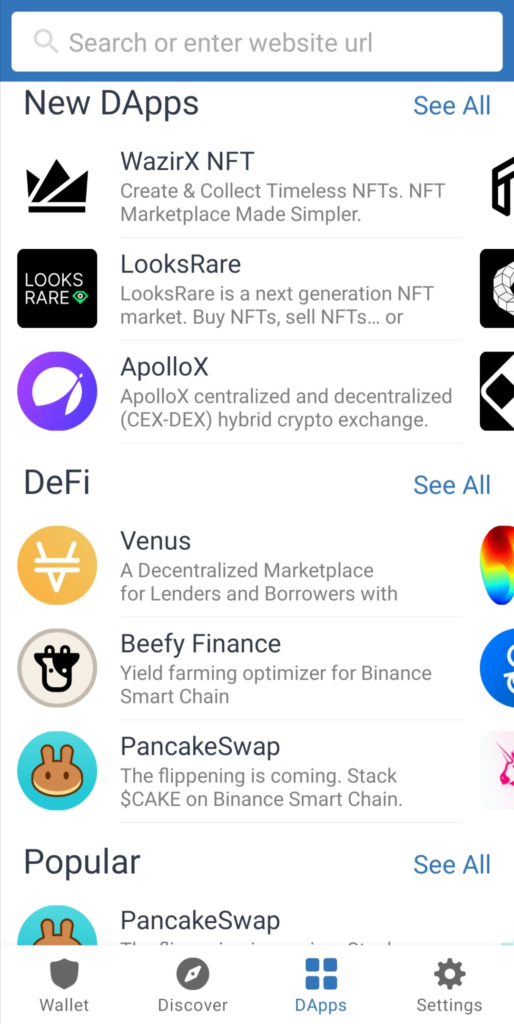

Another choice that is cost-free and simple to use is software wallets. Both custodial and non-custodial versions are available for download as desktop or smartphone apps. The service provider manages and backs up the private keys for you while using a custodial wallet. The private keys are kept in non-custodial wallets using secure components on your device. They may be more suitable for individuals with less experience or lower quantities of DOT, despite the fact that they are more handy than hardware wallets.

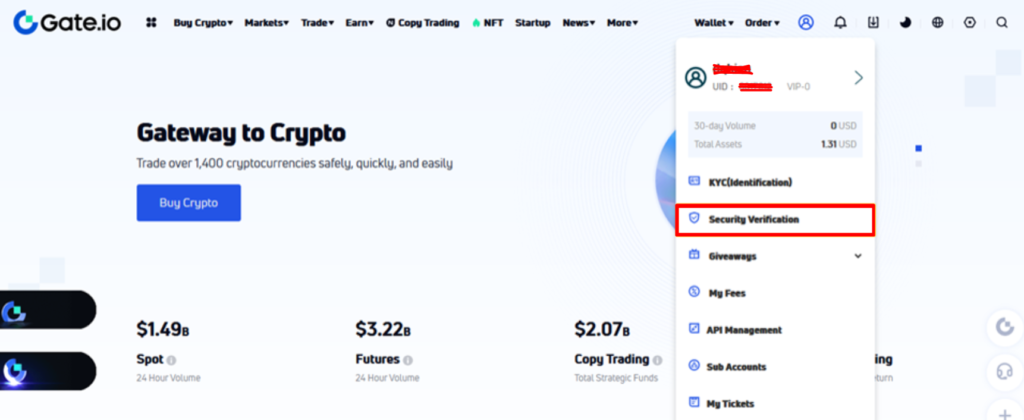

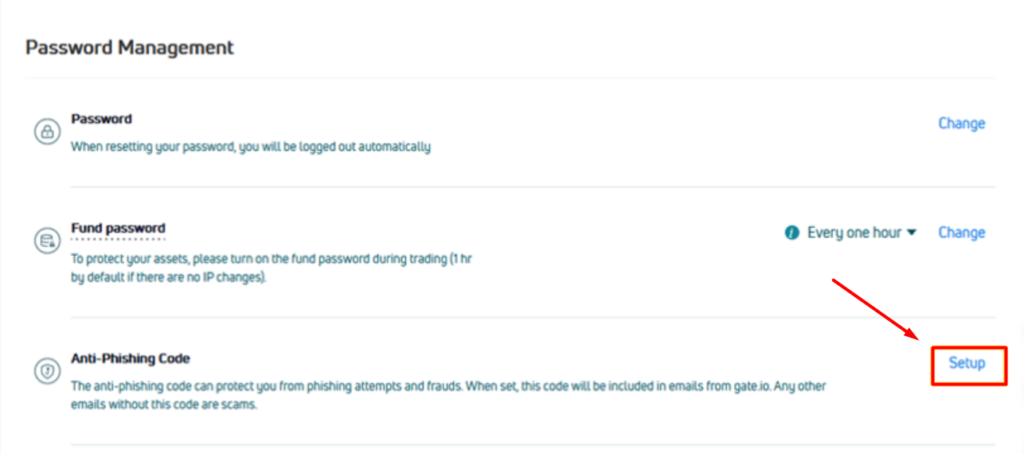

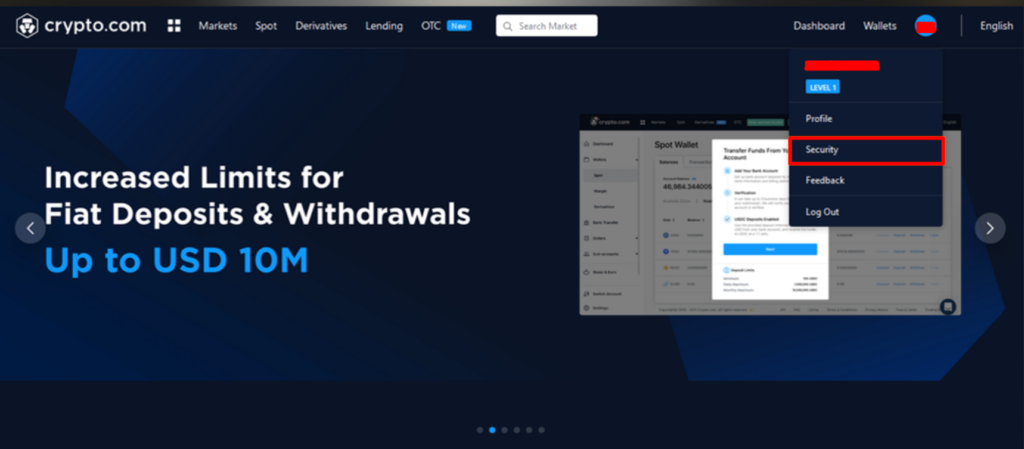

Additionally free and simple to use, online wallets or web wallets may be accessed from a variety of devices by utilizing a web browser. However, they are regarded as “hot wallets” and could not be as secure as hardware or software alternatives. You should pick a trusted company with a solid reputation that has experience in security and custody because you are probably entrusting the platform to handle your DOT. They are therefore best suited for modest holdings or for seasoned frequent dealers.

The Polkadot-JS official online wallet lets you transfer, receive, and store DOT and Polkadot ecosystem currencies as well as take part in staking and voting from inside your web browser. But certainly more experienced users would benefit from it.