A strategy for evaluating the success of Web3 projects in Colombia, Argentina, Kenya, the Philippines, and other emerging markets was released by Stellar Development Foundation.

The Stellar Development Foundation, who created the Stellar network, has published a financial inclusion methodology for evaluating the success of blockchain projects in developing markets. A white paper that was released on September 25 provided an explanation of the framework that was created in collaboration with consultants PricewaterhouseCoopers International (PwC).

By reducing fees to 1% or less, the teams came to the conclusion that blockchain payment solutions dramatically enhanced access to financial goods. They discovered that blockchain-based goods had sped up payments and assisted customers in avoiding inflation.

Some blockchain developers assert that their products can improve “financial inclusion,” i.e., they can give unbanked individuals in poor countries access to services. Making this claim has proven to be a successful method for several Web3 initiatives to raise money. For instance, based on this concept, the UNICEF (United Nations International Children’s Emergency Fund) has highlighted eight blockchain initiatives that it has so far supported.

However, Stellar and PwC warned in their paper that initiatives to improve financial inclusion risk failing if they lack a framework for assessing what is required for success. According to them, “robust governance and responsible design principles are key to successful implementation of any technological innovation.”

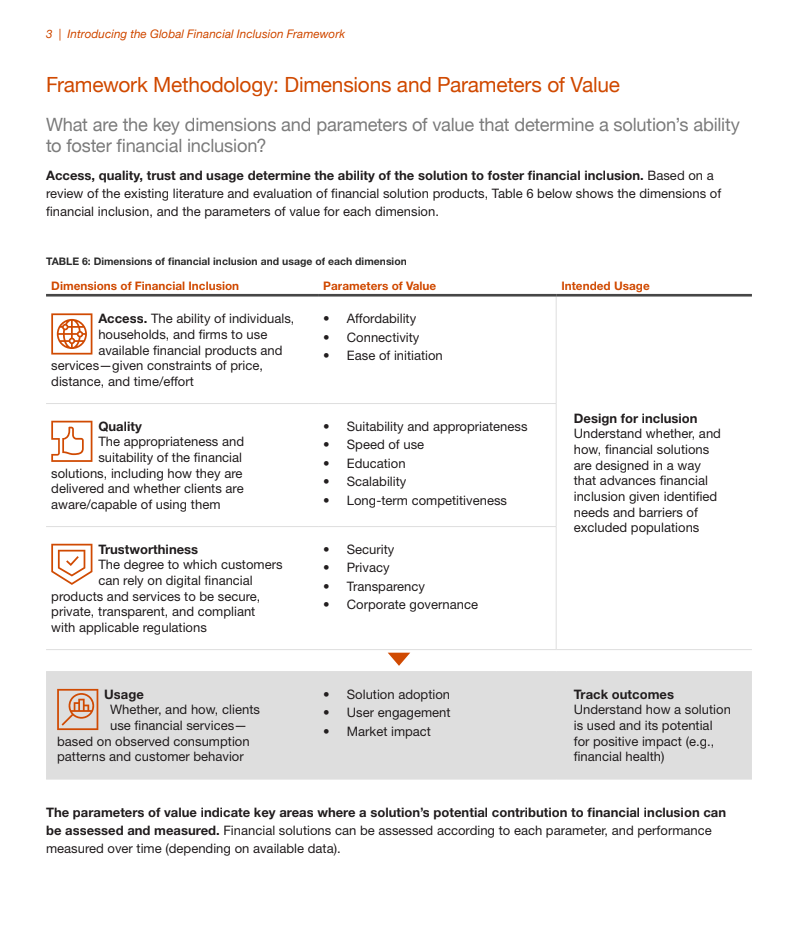

The two teams put up a framework to determine if a project will probably enhance financial inclusion in an effort to support this governance. Access, quality, trust, and utilization are the framework’s four criteria. These parameters are further divided into smaller sub-parameters. As an illustration, “access” is further divided into affordability, connectivity, and simplicity of initiation.

A suggested method of measurement is included in each description of a sub-parameter. As an illustration, Stellar and PwC use the metric “# of CICO [cash in/cash out] locations within relevant target population region” to measure “connectivity”. In order to prevent initiatives from depending solely on speculation, this is meant to assist ensure that they can monitor their success empirically.

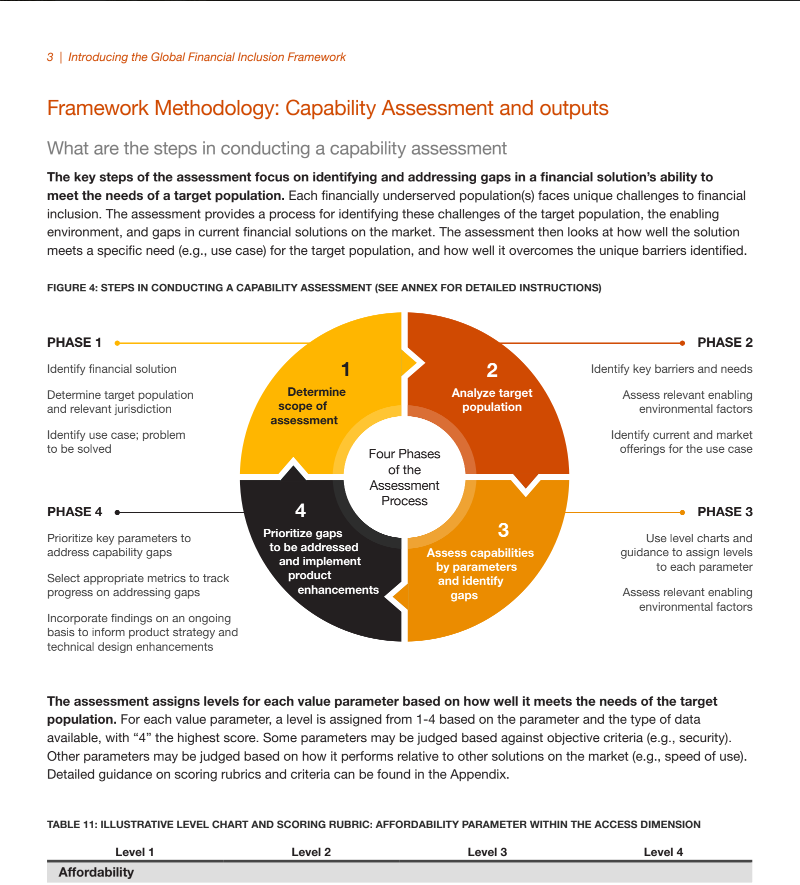

The teams also recommended a four-phase evaluation procedure that projects should go through in order to address the issue of financial inclusion. In the initial step of the project, a solution, target population, and pertinent jurisdiction should be determined. They should identify obstacles that impede the target group from accessing financial services in phase two. They should utilize “level charts and guidance” in phase three to identify the main obstacles to user onboarding. In order to maximize the utilization of finances, they should create final phase solutions that “prioritize key parameters”.

The teams found at least two blockchain technologies that have demonstrated promise for boosting financial inclusion using this paradigm. Paid services come first. Based on an analysis of 12 applications used in Colombia, Argentina, Kenya, and the Philippines, the teams discovered that traditional financial apps charge an average of 2.7–3.5% to move money between the United States and the market under review, but blockchain-based solutions only charged 1% or less. They discovered that by making electronic payments accessible to those who couldn’t normally afford them, these programs expanded access.

Savings was the second sensible answer they discovered. According to the researchers, an Argentine stablecoin application enables users to invest in an asset that is resistant to inflation, preserving their capital when they otherwise would have lost it.

In underdeveloped financial areas, the Stellar network has been at the vanguard of payment inclusion. It established a scheme in December 2022 to help charitable groups disperse monies to benefit Ukrainian migrants fleeing violence. On September 26, it disclosed a collaboration with Moneygram to provide a non-custodial cryptocurrency wallet that may be used in more than 180 nations. The usage of cryptocurrencies in emerging nations has drawn criticism from certain financial and monetary professionals. In a document released on August 22 by the Bank of International Settlements, for instance, it was claimed that bitcoin had “amplified financial risks” in emerging market countries.