Before you can borrow funds and start trading with leverage on Bybit, you must first make a deposit into your wallet or trading account. Exchanges refer to the initial capital the trader offers as the collateral. The amount of collateral necessary is determined by the leverage the trader employs and the overall value of the position they wish to open (known as margin). After that, you can select your trade settings, such as the trade direction (long or short), margin amount, and leverage, by going to the margin trading tab.

Order Types on Bybit

Market orders

Market-taking orders are another name for these orders. They are carried out immediately without waiting for the order book. Fast-moving markets are best suited for this kind of order.

Limit orders

These purchases are sometimes referred to as market-making purchases. They rest on the order book and add liquidity, but they are not immediately executed. They are appropriate for circumstances in which there is little need for urgency.

Conditional orders

These are more complex orders where you can set criteria that must be satisfied in order for them to be implemented. In addition to market and limit orders, conditional orders have the following features:

Close on trigger

This guarantees that, regardless of what occurs, your stop-loss order will be carried out when the price reaches the order point.

Post-only order

Your limit orders will be canceled using this feature if they are not instantly executed at the order price. It guarantees that dealers receive a discount on order pricing (as is customary for limit orders)

Reduce-only order

By using this order type, you can avoid accidentally placing a sell order. To avoid selling your position mistakenly when the market returns to your take-profit point, the system will automatically cancel the order if you have set stop-loss and take-profit orders for a particular trade and the stop-loss strikes before the take-profit.

Long Position Order

Going long on Bybit means borrowing money from the exchange in order to purchase a coin and resell it for a profit. After selling the coins and keeping the profit, the buyer returns the borrowed money to the exchange.

Below is the step-by-step guide.

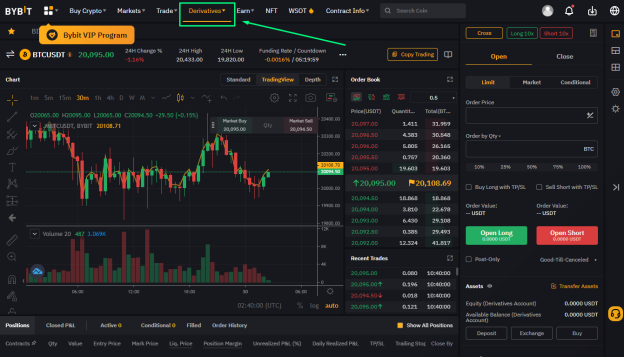

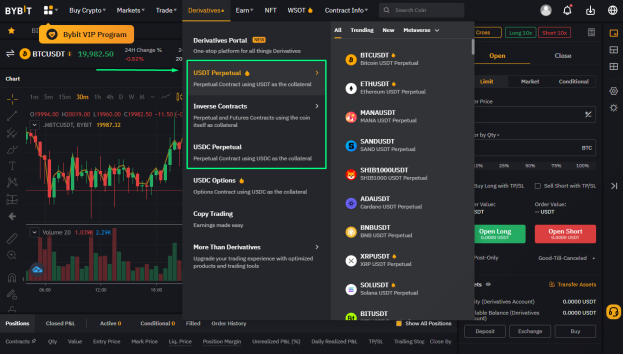

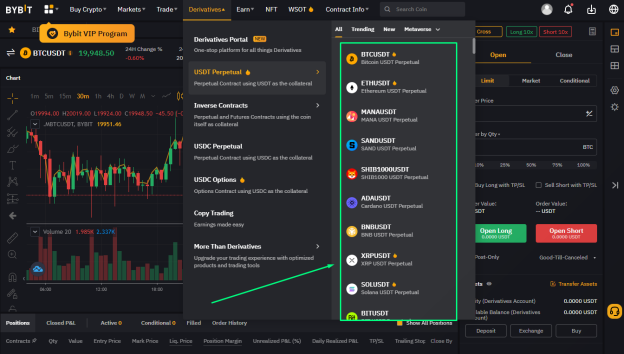

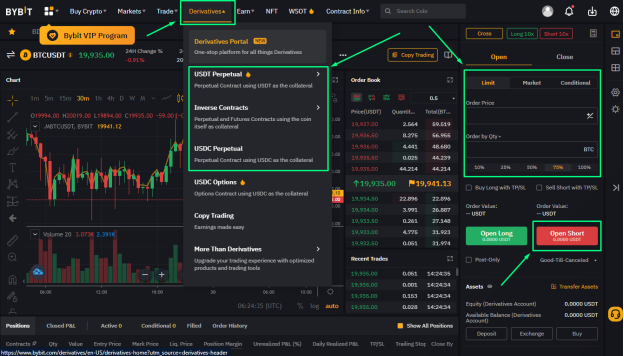

Click on “Derivatives” on the exchange page

Select the kind of contract you want to trade. There are three contract types to choose from:

- USDT Perpetuals

- Inverse Contracts

- USDC Perpetuals

Select the pair you want to trade.

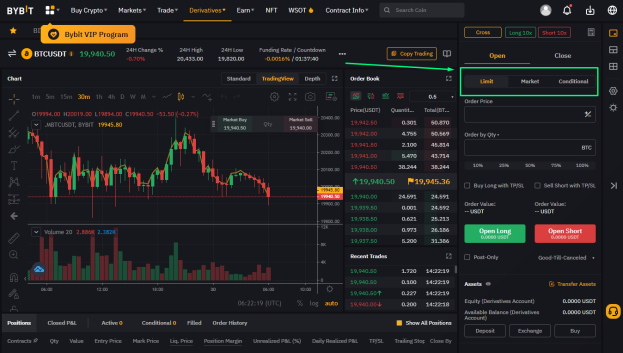

Then, choose your order type. There are three order types you can select from:

- Limit orders

- Market orders

- Conditional orders

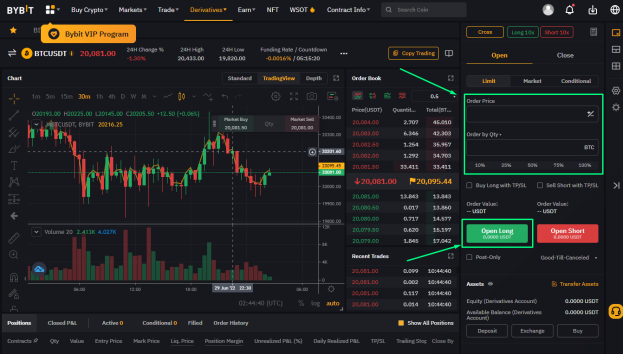

Then enter required variables such as “Order Price” and “Order Quantity” and “Leverage” click “Open Long” on the left side of the screen to open a long position. Next, enter your ‘Take Profit’ and ‘Stop Loss’ values, and click on “Submit.

Short Position Order

To go short on Bybit, you borrow an asset from the exchange, sell it, and then use the proceeds to repurchase the asset at a loss. After that, you keep the money.

To start a short position, select the type of contract and pair you want to trade under “Derivatives” on the exchange website, enter required variables such as price, size, and leverage, then click “Short/sell” on the right side of the screen. Next, enter your ‘Take Profit’ and ‘Stop Loss’ values, and click on “Submit.

You can also read our previous article on Bybit and Leverage Trading – Introduction to Bybit and Leverage Trading

To get more tips in trading on Bybit, click on the link below – ByBit: Strategies on Leverage Trading

Bybit is a great platform for seasoned cryptocurrency traders seeking for an exchange with more advanced features. There are many user-friendly exchanges with straightforward interfaces available right now to help new investors get started in the cryptocurrency market, but such are typically not suitable for serious traders.