Crypto futures are contracts between two parties wherein they agree to acquire and sell a predetermined quantity of the underlying cryptocurrency at a predetermined future price on a predetermined date and time. They enable you to become familiar with a variety of cryptocurrencies without ever having to own any of them.

For both seasoned traders and those who are new to cryptocurrencies, FTX is a great option for an exchange. FTX is well-liked worldwide since it offers a selection of more than 275 cryptocurrencies and 10 fiat currencies.

FTX Futures Trading Tutorial

Managing Funds on FTX

Unlike other exchanges, you don’t need to split your funds in order to trade any of the FTX futures contracts. FTX will automatically use all of your collateral to backstop all of your positions; simply put any collateral into your wallet and start trading whatever futures you desire. It will be deducted from your central collateral if you gain or lose money on any position.

This implies that all of your portfolio is automatically grouped together; you don’t need to handle ten distinct wallets, currencies, or liquidations.

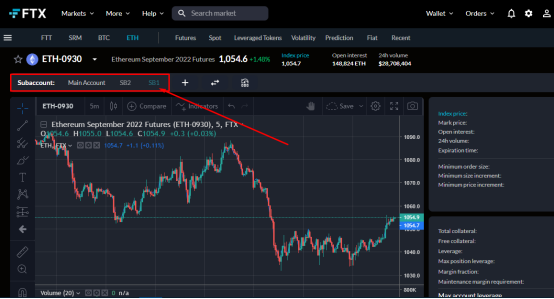

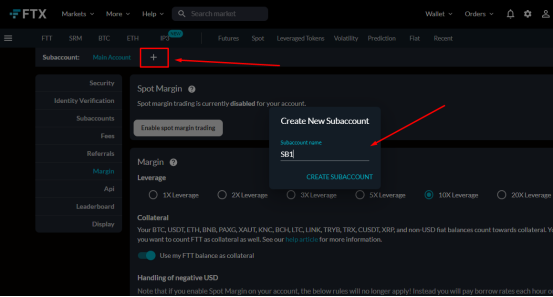

However, you can use subaccounts to separate your positions from one another. You can store money in a subaccount for one position and in a different account for a different position because each subaccount has completely distinct collateral, PnL, etc. You have complete control over this because you can combine or divide your transactions as you see fit.

Here, subaccounts can be made. On that page, you can also move collateral between them.

The simplest way to transition between subaccounts is to use the subaccount bar on trading sites, possibly to change the product you’re trading.

FTX Futures Markets

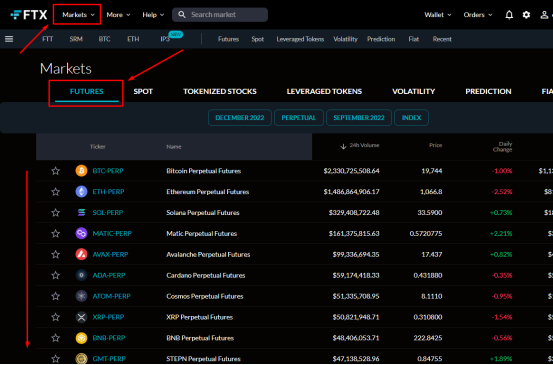

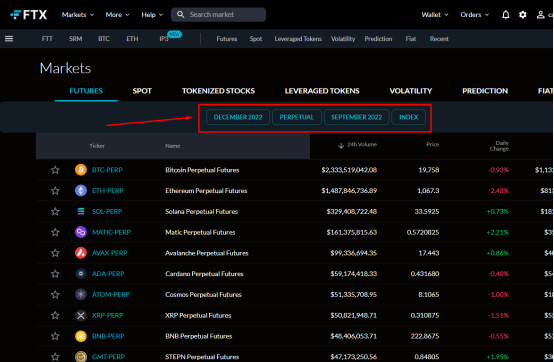

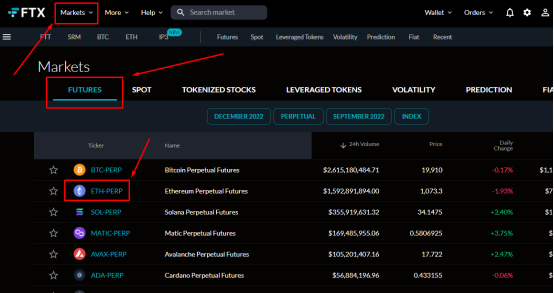

As you can see in the picture below, by clicking on the “Markets” tab from the top, and clicking on “FUTURES” on the next page, it will bring you to a list of Futures available on the platform.

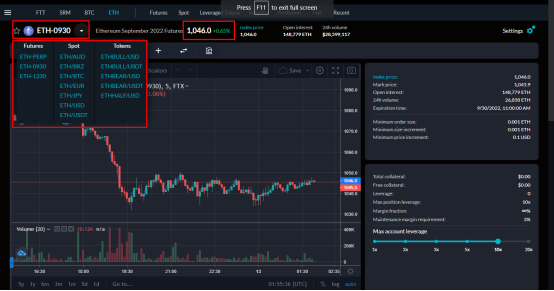

Next, you will also see the types of Futures available on FTX, as shown below. You will see some expiry dates like December 2022 and September 2022. You also got Perpetual Futures and Index Futures. Perpetual Futures, unlike the traditional form of futures, it doesn’t have an expiry date while Index Futures are futures contracts where you can buy or sell a today to be settled at a specified date in the future at an agreed-upon price.

Most of the people trade Perpetual Futures and so it has the biggest markets among them.

Setting up Margin

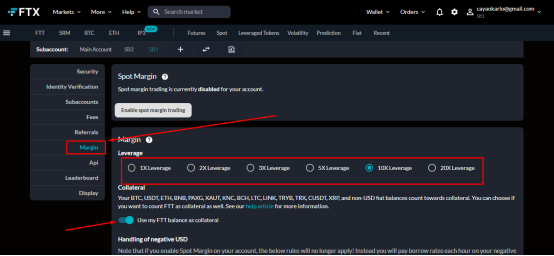

Margin in FTX is always Cross-Margin, which means that all of the assets on your account is used as collateral to fund your futures positions. If you have more than one open positions in an account, all of your assets on that account will be used to fund all of those bets. To avoid potentially wrecking your whole account, one technique is to use Isolated Margin.

Isolated Margin is where you essentially have margin and collateral that you put in account to fund each separate position. So that if one goes south and you are in a long position, that gets wrecked but not your other positions. Therefore, creating sub accounts is recommended.

To create a sub-account, just head over to your account by clicking on your account and click on settings, as shown below.

Click on “+” beside “Main Account” and create a name for the sub-account.

Then, you can set leverage on each of the sub-accounts, including your main account.

Funding Rates

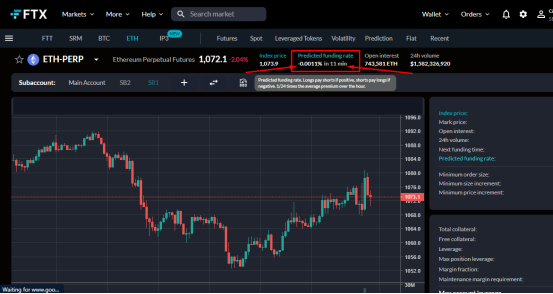

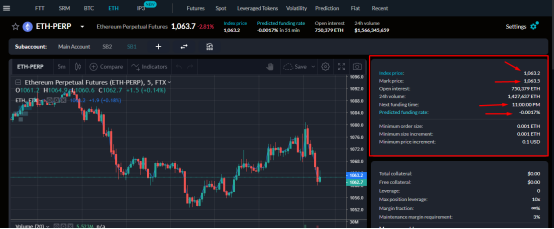

Every Futures Market has a funding rate and unlike other exchanges, FTX charges funding every hour. First, choose the market that you want to trade ,let’s say Ethereum Perpetual Futures.

When clicking on ETH-PERP, it will bring you to the trading screen. The important thing to note about funding is that there is a “Predicted Funding Rate” and a time left to wait for the next funding. As you can see in the picture below, there is a -0.0011% Funding Rate and the next funding is in 13 minutes. That means a trader will be paying another trader in thirteen minutes with the said interest rate.

In Futures trading, when you go “Long”, it means you are trading with someone else that is going “Short” and vice versa. On the right side of the trading screen, you can see that you have the index price and the mark price. If the mark price is above the index price, it means that longs will paying shorts and otherwise, shorts will be paying longs.

So in the case of the picture below, mark price is above the index price (which happens most of the time), therefore longs will be paying shorts with the given “Predicted Funding Rate” at the give “Next Funding Time”.

Futures Trading

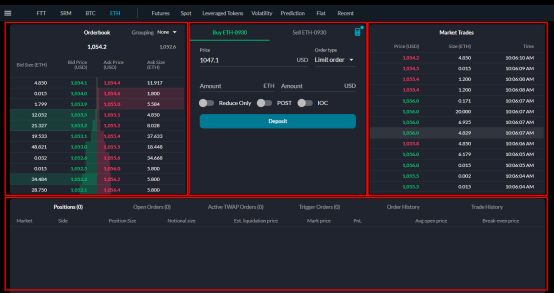

For a brief overview of the trading screen, you will see the market on the top-left corner where you can change anytime and the Price next to it.

Scroll down and you will see the order book. There you will see the current market price moving, bids are on the left in green and asks are on the right in red. Next to the order book is the Order Entry form where you enter the price, order type and amount of your trade. On the far right side is the list of current market trades. Underneath is where your own current positions, open orders, trade history, etc. are listed.

For basic technical analysis, read our article TIPS AND STRATEGIES ON TRADING FUTURES ON FTX.

Order Entry

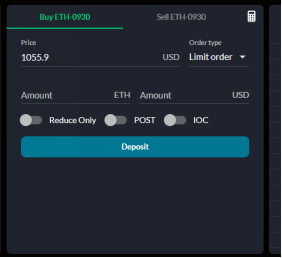

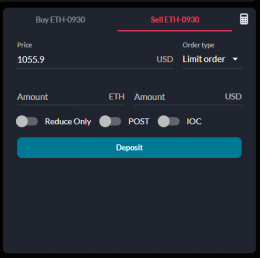

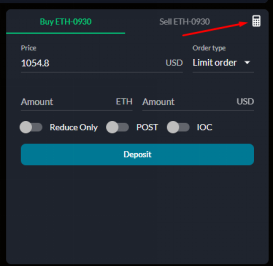

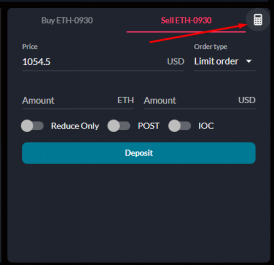

Or you can advance your order type by using the calculator. To use the calculator, just click the icon at the top-right corner of the fom.

Using the calculator is much more in-depth. In the Calculator you will want to enter your buy/sell price, your “Take profit exit” and “Stop loss” values based on your technical analysis. For basic technical analysis, read our article TIPS AND STRATEGIES ON TRADING FUTURES ON FTX.

A stop-loss is used to communicate to your broker how much you are willing to risk on a trade. A take profit is pretty much the exact opposite. It informs your broker of the maximum profit you’re ready to realize from a single trade, and it allows you to close the trade if you’re satisfied with the result.

Once you are happy with your order, press “Deposit” button. You will find your current positions just right below the “Order” form where you can cancel or edit them.

Check our first article about FTX – Introduction to FTX and Crypto Derivatives.

FTX is a relatively new cryptocurrency exchange that has gained a reputation for being a reliable and feature-rich trading platform. It houses a variety of derivatives to trade in the platform. FTX is built both for seasoned traders and cryptocurrency beginners as well.